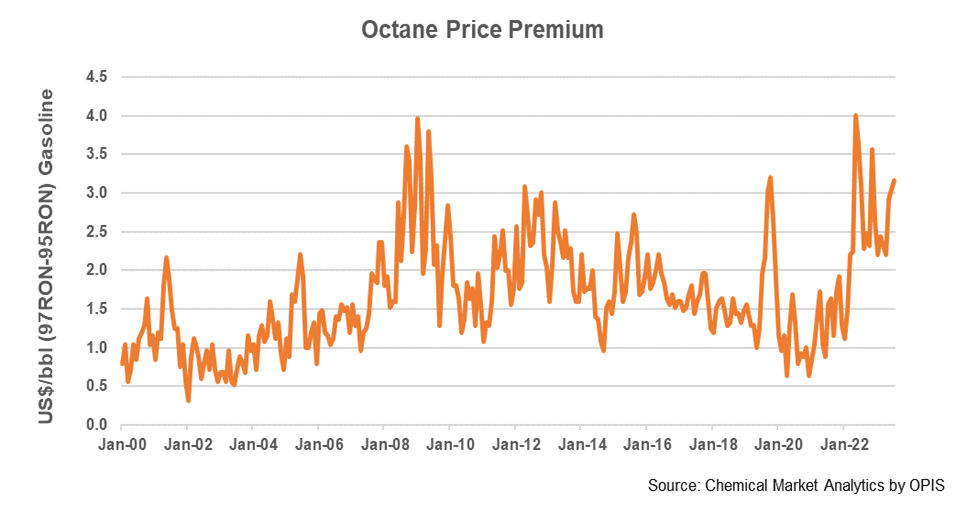

Return of the “Octane Barrel”?

Gasoline cracks and octane premium (see Figure 1) values are at an all-time high due to a combination of post-covid recovery and various geopolitical factors. This trend is expected to continue in the short term. Historically, FCC units have been the workhorse unit in meeting the gasoline pool demands within a refinery configuration. However, over last two decades, a significant proportion of grassroot, new FCC installations— especially in Asia— have been geared towards light olefins maximization. These units have been designed to target the higher value associated with downstream chemicals and capture the benefits of refinery petrochemical integration. Given the current weaker pricing of C3= compared to gasoline, what are the viable options for FCC operators to maximize margins in this current environment?

According to FCC Regional Technical Service Manager at Ketjen, Subramani Ramachandran, the Ketjen team has studied the implications of current product pricing through a series of internal case studies. The study revealed that there is no one-size-fits-all. It depends on the individual refinery configuration. For most FCC operators, in the current pricing scenario, maximizing overall FCC octane barrels from FCC complex will be the primary objective. While there are multiple pathways to achieve this objective, the key to achieving maximum gasoline octane barrels is to ensure that you fill up your downstream Alkylation and MTBE/ETBE units, without sacrificing gasoline volume and bottoms upgrade. Customized catalyst design, with an optimum molecular selectivity, is a key determinant to success.

Figure 1: Historical Octane Price Premium

Considering the diverse range of FCC operations in Asia, Subramani says, “If your FCC unit has been designed with the objective of maximizing light olefins, the typical FCC gasoline octane is quite high (>94 RON), given the higher reactor severity and the formulation design considerations to maximize C3=. Additionally, these FCC complexes are likely to have relatively larger downstream Alkylation or MTBE/ETBE units.” In such a scenario, the economic optimum may be achieved by tuning the yield profile to maximum C4= yields up to the limit of downstream Alkylation and MTBE units, while minimizing C3= and maximizing gasoline yields, through a combination of process optimization and catalyst reformulation.

On the other hand, if your operation is a traditional FCC operation which is geared towards gasoline maximization, it is worthwhile to further explore how better profitability can be achieved by carefully balancing gasoline, C4= and bottoms yield. Ketjen’s DENALI® ACTION® and DENALI® ACTION+TM have been widely applied in the US market over the last two decades, targeting this rebalancing when Tier II gasoline regulations came into effect. These catalysts are designed to maximize C4= yields within an LPG yield constraint while maximizing upgrade of bottoms to gasoline. In multiple commercial (> 15) trials, they delivered an economic value upgrade ranging from 0.5 to 1.6 $/bbl, compared to best-in-class competitive systems.

About Ketjen

Ketjen is a provider of advanced catalyst solutions to leading producers in the petrochemical, refining and specialty chemicals industries. From fluidized catalytic cracking to clean fuels solutions to hydro-processing to organometallics and curatives, Ketjen delivers safe and reliable solutions that increase production performance and business value. A wholly owned subsidiary of Albemarle Corporation (NYSE: ALB), Ketjen Corporation is headquartered in Houston, Texas, and serves global customers through operations in 27 markets. For more information, visit www.ketjen.com.