Indonesia’s petrochemical projects to boost national economy, international standing

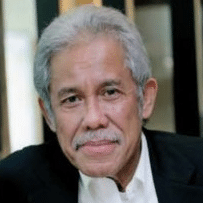

Exclusive interview with Rudy Radjab, President Director of PT Kreasindo Resources

Indonesia’s new national projects have the potential to cover half of Southeast Asia’s petrochemical demand, says Rudy Radjab, President Director of PT Kreasindo Resources, an initiator of refineries in Indonesia.

A number of initiatives are set to boost the country’s petrochemical power and cement Indonesia’s position as a manufacturing leader in the post-pandemic market.

Here, he shares with Asian Downstream Insights perspectives on Indonesia’s petrochemical journey, how public sector support can help attract private sector investment, and his advice for the next generation of a digitally native workforce.

National projects for international markets

The power of petrochemicals through the pandemic is well-known. As detergents and single-use plastic packaging soar, even outside China and India, Asia’s petrochemical product growth has risen by “3-4% per annum” and Indonesia’s by “5-6%”, says Radjab.

For Indonesia, “combining [traditional fuel refineries] with petrochemical[s] or crude to chemicals is a must” to stay competitive, and a way to not only address domestic needs, but also boost Indonesia’s influence on the wider Asian landscape.

“[We are a] population of about 270 million people that needs petrochemical products both [from] upstream (olefin) and downstream (aromatics)”, Radjab sets out. Big developments are needed to meet these big demands.

National strategic projects such as the Refinery Development Master Plan, and Pertamina’s USD 48B investment into refining and petrochemical activities across the country, have the potential to quadruple the country’s petrochemical production capacity, surpassing domestic demand, and allowing new avenues for export. This is a valuable new economic opportunity, especially with Indonesia’s position as a signatory of the 2016 Paris Agreement, which restricts fuel exports.

“Outside China and India, supply and demand of petrochemical market in the region is around 20 to 30 million metric ton per annum (mmta)”, explains Radjab. “Assuming the Pertamina project[s] [are] completed and running well, [our] production capacity will be 12 to 15 mmta”. This means “[We] would be able to fulfill 50% of regional demand”.

Private/public collaboration powering petrochemical progress

Radjab considers public private collaboration crucial if Indonesia is to establish itself as global leader in the next phase of the energy transition.

“In terms of project financing, the funder usually requires government involvement as the private sector strategic partner rather than 100% equity owned by the private sector”, he describes. “That is why collaboration between government and private sector is so important”.

When it comes to investing in new projects, public sector involvement can also help add a sense of security. “[Investors] or foreign partners feel more secure with the involvement of the government, either as part of the project ownership or as an off-taker”, suggests Radjab. Such projects could include those like Southeast Asian chemical giant Lotte Chemical Indonesia’s USD 3.5 billion ethylene project, set for completion in 2023: a symbol of the company – and the country’s – ambitious energy plans.

With national leaders showing increasing flexibility and willingness towards foreign investment, and their recent pledge of 246.26 trillion rupiah (17.59 billion USD) towards the implementation of new projects across the upstream and downstream sectors, the Indonesian government is investing both research and resources into petrochemical progress.

Manual over machine: lessons for a digital future

Innovation is a key part of this journey. But the spotlight on new technologies should not eclipse the needs of your manual workforce. Industry 4.0 – defined by Radjab as “the shifting of current industrial practice to…modern smart technologies” – can “improve quality, reduce costs and increase efficiencies. But he also firmly believes that in this hyperconnected new normal, operators’ first area of focus should be human, not digital, development.

“Currently the operators in Indonesia are migrating from manual to digital platforms”, explains Radjab. “In facing the current economic uncertainty and the slow progress of running projects it is better to develop human resources to their maximum potential as an asset for future to be ready for [these] digital platforms. With the majority of Innovation leaders across the ADI network recently revealing that “culture” was a key concern when it came to implementing digitalisation processes, Indonesian downstream business leaders should provide the resources and training for their workforce to adapt to the uptake of new technologies.

Next generation leaders for next generation downstream

As this workforce welcomes its next generations, Radjab has some worldly advice for his millennial and Gen Z colleagues.

“Refinery 4.0 is a new challenge and need innovations”, he warns. “Operator rounds or inspections will be replaced with sensors, thermal cameras and drones”. To keep up, “analytical thinking is required to be able to interpret big data”, and the time to cultivate this is now.

The new virtual workplace is borderless, and without limits, especially when it comes to diversity. “These types of career have no gender boundaries”, says Radjab, advocating a move towards a more agile, egalitarian workforce. In the innovation-driven, petrochemical-powered next phase of the energy transition, there will be no restraints: on the potential of engineers who embrace technology, or the challenges that they may face. As his final words of wisdom warn: “Be prepared for it.”

Read more:

- Aramco to Acquire 50% Stake in Air Products Qudra’s Blue Hydrogen Industrial Gases Company

- SK Innovation and SK E&S Announce Merger, Forming Asia-Pacific’s Largest Private Energy Company With Assets of KRW 100 Trillion

- Indorama Ventures Secures $200 Million Loan From IFC to Drive Sustainability Program

- Aramco’s Strategic Gas Expansion Progresses With $25bn Contract Awards

- GC CEO Narongsak Jivakanun Reveals Vision to Continue 3 Steps Plus Strategy and Drive Map Ta Phut to Become Southeast Asia Hub