Key pillars for the future of downstream

The crude oil refining industry is currently facing a great challenge, as refiners continue to face the realities of the ongoing energy transition, price volatility of raw materials, pressure from society to reduce environmental impacts, and increasingly lower refining margins.

Historically, growth in the refining industry was sustained by transportation fuels. Today, the downstream industry is faced with a deep reduction in the demand transportation fuels, with the biggest threat being the reduced demand from consumer markets, and news about countries intending to reduce or ban the production of vehicles powered by fossil fuels.

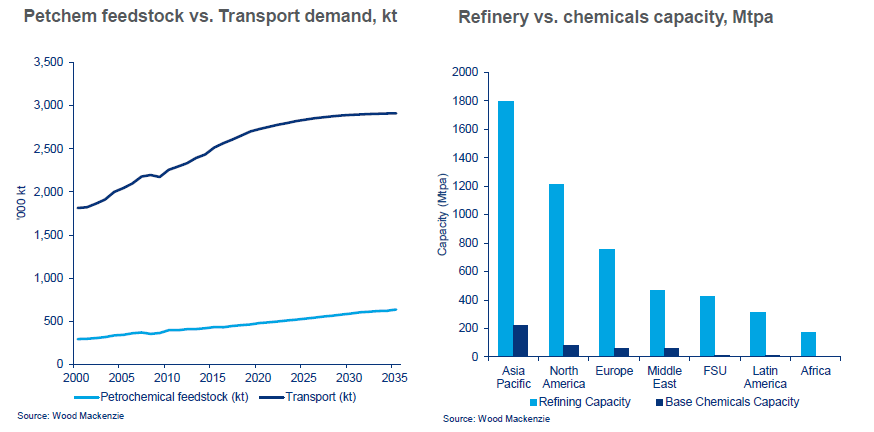

However, despite recent forecasts, this demand for transportation fuels remains the main revenue driver for the downstream industry today, with close to five times more demand than petrochemical feedstocks.

Recent observations show a trend of stabilisation in transportation fuels demand close to 2030, followed by a growing petrochemicals market.

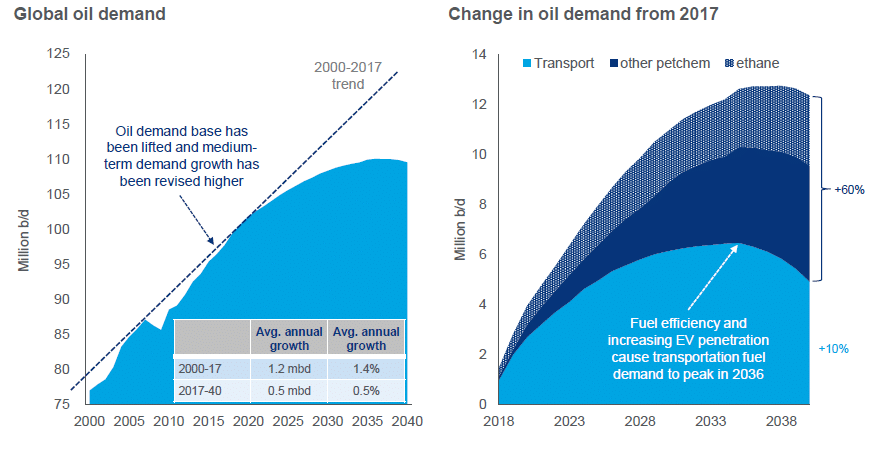

According to data presented in Figure 2 (below), demand for transportation fuels is expected to peak in 2036, mainly due to improvement in fuel efficiency and a growing market for electric vehicles.

New technologies like additive manufacturing (3D printing), and the availability of lighter crudes, have the potential to further disrupt demand.

Survival of the fittest

Restrictive regulations like IMO 2020, which required refiners to lower sulfur content from 3.5% to 0.5%, added pressure for refiners with low bottom barrel conversion capacity. Refiners with easy access to low sulfur crude oils, and adequate bottom barrel conversion capacity, presented a competitive advantage, and could rely on relatively low cost residue upgrading technologies to produce the new marine fuel oil, but they are a minority in the market.

Most refiners need to look for sources of low sulfur crudes, or deep bottom of barrel conversion technologies, which present higher costs, putting margins under pressure. It is safe to say that the downstream industry of the future will be sustained by four main pillars: Petrochemical integration, high bottom barrel conversion, renewables co-processing, and clean hydrogen production routes. Refiners that can successfully implement these pillars together will come out as winners.

Refinery-petrochemical integration

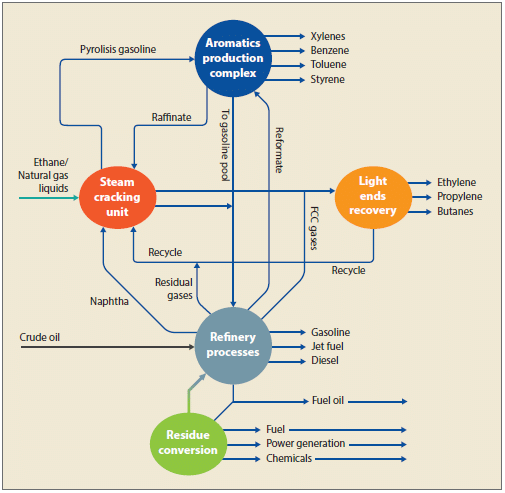

The industry is now looking at alternate ways to ensure survival and sustainability in the long term. An integration between refining and petrochemicals is one way in which the industry can seize synergies, reduce operational costs and unlock value.

Table 1 presents the main characteristics of the refining and petrochemical industry and the synergies potential.

| Refining Industry | Petrochemical Industry |

| Large feedstock flexibility | Raw material from naphtha/NGL |

| High capacities | High operation margins |

| Self-sufficient in power/steam | High electricity consumption |

| High hydrogen consumption | High availability of hydrogen |

| Streams with low added value (unsaturated gases and C2) | Streams with low added value (heavy aromatics, pyrolysis gasoline, C4s) |

| Strict regulations (benzene in gasoline, etc) | Strict specifications (hard separation processes) |

| Transportation fuels demand declining at global level | Products high in demand |

The integration potential and the synergy between the processes relies on the refining scheme adopted by the refinery and the consumer market. Process units such as Fluid Catalytic Cracking (FCC) and Catalytic Reforming can be optimised to produce petrochemical intermediates to the detriment of streams that will be incorporated to the fuels pool. In the case of FCC, the installation of units dedicated to produce petrochemical intermediates, called petrochemical FCC, aims to reduce the generation of streams to produce transportation fuels. However, the capital investment is high once the severity of the process requires the use of material with noblest metallurgical characteristics.

Renewable co-processing in crude oil refineries

As the global energy transition gathers speed, the drive to decarbonise and reduce the environmental impact produced by fossil fuels, is having a profound effect on the refining and petrochemicals sector, with a structural shift accelerated by the COVID-19 pandemic. Refiners are now looking to increase the production of renewable fuels and using renewable raw materials in the feed stream of crude oil refineries.

The adoption of synergies between fossil fuels and renewables in the downstream industry varies across regions, and is dependent on the availability of renewable raw materials as well as the capacity of the installed refining hardware to process the renewable streams.

Despite advantages of reducing the environmental footprint, renewables processing presents some technological challenges for refiners. The great oxygen content and chemical unsaturation requires high demand for hydrogen, putting under pressure refineries with hydrogen bottleneck.

Another challenge associated with renewables processing is the cold start characteristics of the derivatives, mainly Diesel and Jet Fuel. As an example, the Brazilian refining market is the seventh largest crude oil derivatives consumer in the world, with a demand of 2.3 million barrels per day; it is also the third largest consumer of transportation fuels, and close to 550 thousand barrels are supplied by renewable fuels, mainly biodiesel and ethanol.

Renewable hydrogen generation routes – A fundamental enabler to the energy transition

Hydroprocessing technologies play a fundamental role in any refining hardware, but this has a side effect due to the high CO2 emissions during the natural gas steam reforming process to produce hydrogen.

Some refiners are adopting the co-processing of renewable materials in crude oil refineries, in their aim to produce high quality and cleaner transportation fuels. Despite the advantages that reducing an environmental footprint can provide, renewables processing presents some technological challenges to refiners.

Renewable streams have a large number of unsaturations and oxygen molecules which lead to high heat release rates and high hydrogen consumption, and subsequently the need for higher capacity of heat removal from hydrotreating reactors so as to avoid damaging catalysts.

This leads to the need for increased hydrogen production capacity for the refiners as well as more robust quenching systems of hydrotreating reactors or, in some cases, the reduction of processing capacity to absorb the renewable streams.

Technology licensors will perhaps need to direct their efforts toward looking for alternative methods of large-scale hydrogen production in a more sustainable manner. Some alternatives can offer promising advantages:

- Natural gas steam reforming with carbon capture – However, carbon capture technology and cost can be limiting factors among refiners;

- Natural gas steam reforming applying biogas – The main challenge in this alternative is a reliable source of biogas as well as their cost;

- Reverse water gas shift reaction (CO2 = H2 + CO) – One of the most attractive application methods, mainly to produce renewable syngas; and

- Electrolysis – One of the more promising technologies for the near future.

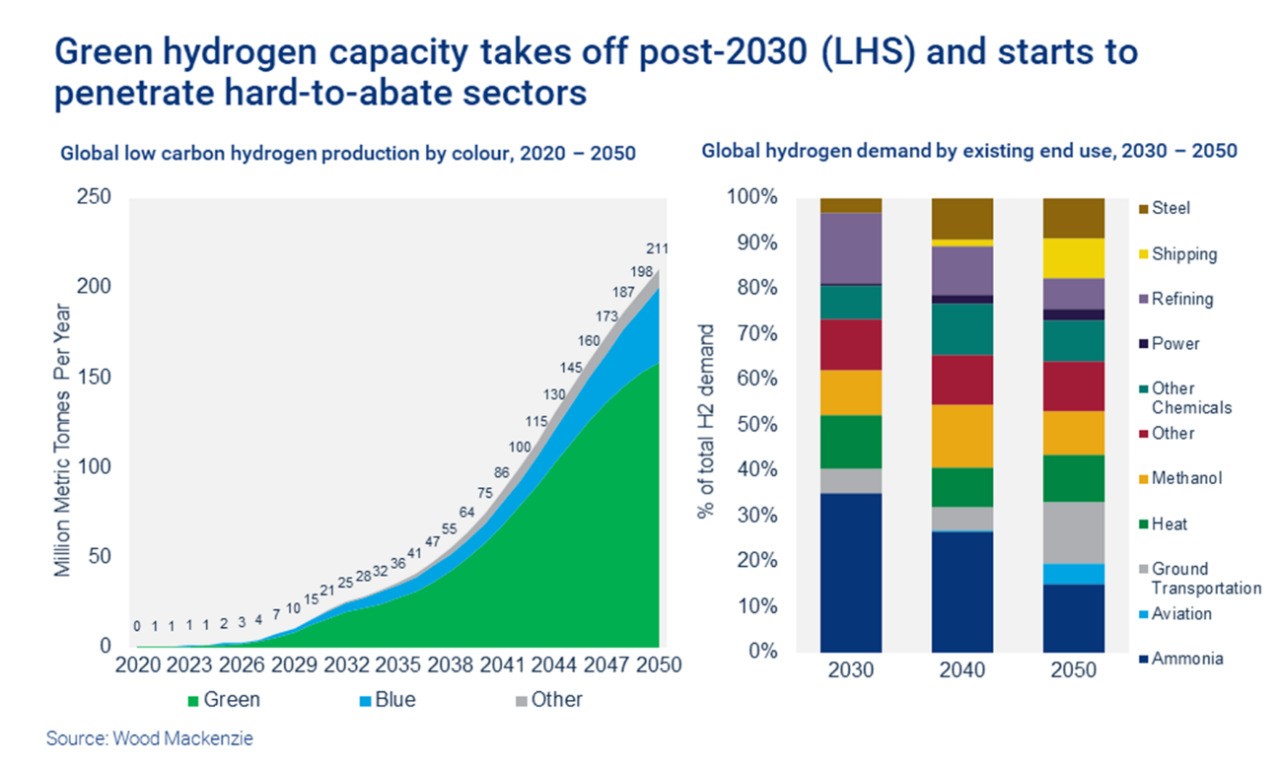

Hydrogen is a key enabler to the future of the downstream industry and the development of renewable sources of hydrogen is fundamental to the success of effort toward the adoption of a lower carbon profile. According to the Wood Mackenzie data, the Green and Blue hydrogen generation routes are poised for takeoff in the coming years.

In the current scenario, the best alternative for refiners is to optimise the consumption of hydrogen, minimise operating costs and CO2 emissions, thus reducing hydrogen wastage in the PSA process and burning in flare systems.

The future energy mix

The synergy between refining and petrochemical processes increases the availability of raw material to petrochemical plants and makes the supply of energy to these processes more reliable, while ensuring better refining margins due to the high added value of petrochemical intermediates when compared with transportation fuels.

The development of crude-to-chemicals technologies reinforces the necessity of closer integration of refining and petrochemical assets by brownfield refineries aiming to face the new market that tends to focus on petrochemicals against transportation fuels. It is also important to note the competitive advantage of Middle Eastern refiners that have easy access to light crude oils which can be easily applied in crude-to-chemicals refineries.

Crude-to-chemicals refineries are based on deep conversion processes that require high capital spending – a fact that increases pressure on refiners with restricted access to capital, again reinforcing the necessity of close integration with the petrochemical sector to achieve competitiveness.

The renewables co-processing as decarbonisation strategy is already a reality in the downstream industry and a growing trend being considered a pillar to the new downstream industry. Despite the environmental advantages, renewables co-processing poses a great challenge to the players of the downstream industry, especially relating to the higher demand for hydrogen, and not only is the quantity important, it is also necessary to look for cleaner alternatives to produce hydrogen. Hydrogen is already a key enabler to the crude oil refining industry: Hydroprocessing technologies became fundamental to the downstream industry both to produce high quality and cleaner derivatives, or to prepare feedstocks to processing units like residue fluid catalytic cracking. This dependence grew stronger after the start of IMO 2020, which required a deep treatment of bottom barrel streams aiming to comply with the new quality requirements of the marine fuel oil (Bunker). In this sense, the hydrogen generation units were a strategic choice for refiners, and the efficient and reliable operation of these units needs to be a priority for refiners.

It is important to understand that the energy transition is no longer a matter of choice for the players of the downstream industry. It is a reality, and the efforts to find cleaner sources of hydrogen need to be supported with refiners aiming to minimise the environmental impact of crude oil processing chain while at the same time to ensuring the production of high quality and added value derivatives.

Decarbonisation of the energy matrix requires even more flexibility and agility by refiners aiming to keep and improve their refining margins in the scenario of reduced demand for transportation fuels and growing demand for petrochemicals. However, there are also processing technologies available that are capable of allowing the co-processing of renewables and fossil feed streams in crude oil refineries, reducing the environmental impact of the downstream industry.

Dr. Marcio Wagner da Silva is a Process Engineer and Transfer and Storage Manager focusing on Crude Oil Refining Industry based in São José dos Campos, Brazil. Bachelor’s in chemical engineering from University of Maringa (UEM), Brazil and PhD. in Chemical Engineering from University of Campinas (UNICAMP), Brazil. Has extensive experience in research, design and construction to oil and gas industry including developing and coordinating projects to operational improvements and debottlenecking to bottom barrel units, moreover Dr. Marcio Wagner have MBA in Project Management from Federal University of Rio de Janeiro (UFRJ) and is certified in Business from Getulio Vargas Foundation (FGV).