Capture Value by Processing Resid in the FCC

By:

Lamma Khodeir, W. R. Grace & Co., Segment Marketing Manager, FCC

Gary Cheng, W. R. Grace & Co., Regional Marketing Manager, FCC, Asia Pacific

Rafael Gonzalez, W. R. Grace & Co., Regional Marketing Manager, FCC, EMEA

Bob Riley, W. R. Grace & Co., Regional Marketing Manager, FCC, Americas

Rene Gonzalez, Author on behalf of W. R. Grace & Co.

Fluid Catalytic Cracking (FCC) conversion technology is scaling up, providing more options for competing against a confluence of market and regulatory forces. Many of the options under consideration involve increasing resid conversion through the FCC unit. Historic demand destruction in 2020 has lowered FCCU operating rates. These turndowns change the traditional constraints on the FCC, especially unit heat balance, that can be restored by processing resid.

Against this backdrop, high-margin opportunities are emerging in the petrochemical feedstock market. In fact, several distinguished speakers at the 2020 American Fuel and Petrochemical Manufacturers (AFPM) Summit commented that the COVID-19 pandemic is accelerating market expansion of chemical building blocks such as propylene. This suggests opportunities for upgrading resid to petrochemicals and marketable fuel components such as high octane alkylate.

In 2020, global crude oil production declined to about 94 million bpd because of the COVID-19 pandemic, compared to about 100million bpd in 2019. Industry analysts project 102 million bpd of crude production projected by 2025. Additional refining capacity of 7.2 million b/d has been announced and is expected to come online between 2020 and 2027 through new mega- refining projects. Older and lower- complexity facilities suffering from poor margins may be forced to shut down permanently. Refineries which remain face a variety of challenges in the future and may suffer from a lower margin environment during the COVID recovery.

To improve profits in such a challenging low product margin environment, one of the best options available to refiners is to process heavier, low cost feedstock such as residual streams in their FCC unit, while adapting conditions to produce the ideal product slate. Higher severity FCC conditions generated when processing resid can result in short contact times for increasing LPG olefins yield. Equipment upgrades allowing FCC operations at high severity involve strippers, injectors, cyclones, and improved metallurgy and refractory. An added benefit is that aromatics recovery is especially attractive for use with feedstocks produced from high severity FCC operations.

Resid-capable FCCUs operating at high severity require the right catalyst design with balanced mesoporosity resilient enough to allow diffusion of the large resid molecules into and cracked valuable products out of the catalyst without the coke and gas penalty experienced with conventional matrix catalysts. The endgame is to leverage FCC resid processing for efficient downstream integration into the petrochemical value chain.

Market deviations due to COVID-19

Personal mobility restrictions around the world due to the COVID-19 pandemic have caused a significant reduction in petroleum demand. The sharp drop in demand has forced some refiners to shut down while others are reducing crude runs. Furthermore, refiners have considered the rerouting of certain streams and explored enhanced integration with petrochemical facilities, all with the goal of reoptimizing refinery flow in this unique operating system.

Lower charge rates appear to be the new normal in today’s market. However, lower charge rates can provide additional flexibility and capacity for the air blower and wet gas compressor (WGC), allowing higher processing of resid or other low value feedstocks. FCC unit turndowns create a wide range of challenges for operators affecting unit heat balance, cycle length, etc. However, the lower charge rates can enable resid processing flexibility with a wider range of feed qualities that can restore the heat balance and provide opportunities to generate value.

As refiners re-balance their product portfolio going into the new decade, they can satisfy the heat balance by blending in a heavier feedstock like resid, that may be further enhanced by recycling slurry, increasing regenerator air preheat, or other tactics.

Beyond 2020

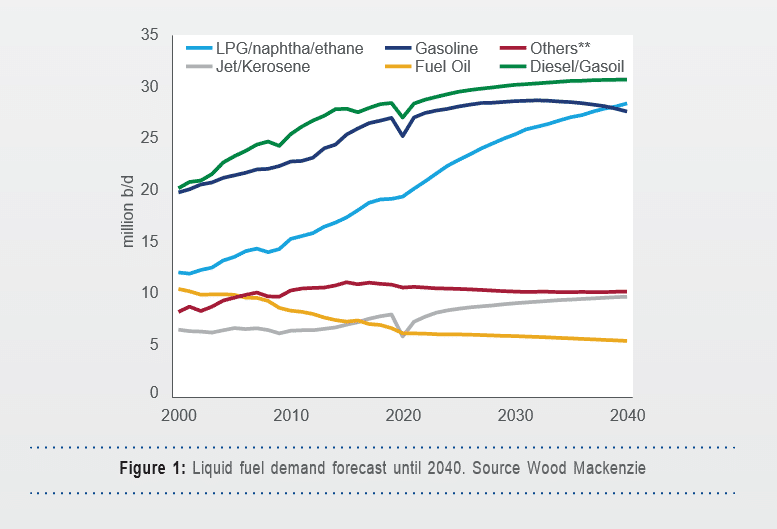

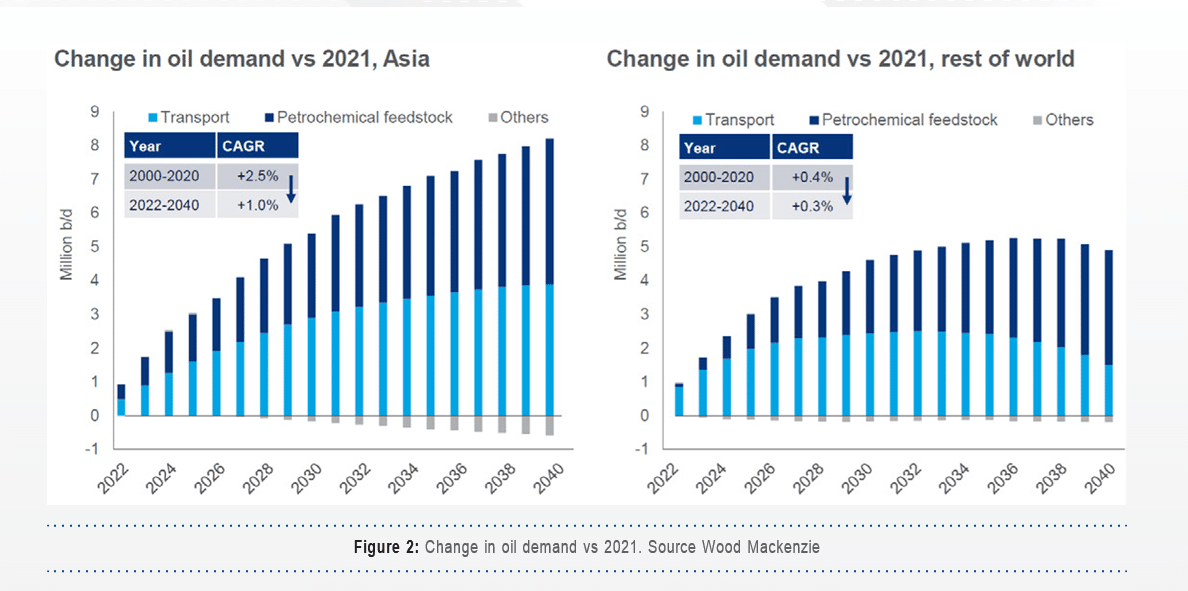

Global market trends are indicating slowing transportation fuel demand growth, shifting focus to petrochemical production. Growth in gasoline demand is predicted to continue, however slows down through 2030 due to growing electric vehicle market and improved fuel efficiency. The growth in LPG and naphtha is driven by its use as a petrochemical feedstock.

While Asia long-term demand projections are positive for both petrochemical feedstock and transportation fuel, the rest of the world is expected to experience petrochemical feedstock demand growth but a drop in transportation fuel demand from the mid-2030s. This may motivate refiners to focus more on resid processing to provide a feedstock cost advantage while meeting product demand.

Energy transition impacts

One aspect of the global recovery from the COVID-19 pandemic is an increase in the global interest in pursuing energy transition and sustainability goals. Many of the scenarios presented by industry analysts suggest that a reduction in carbon-based transportation fuels is necessary to accomplish the climate- related ambitions aligned with the Paris Accord.

A variety of new technologies, including electric vehicles, new fueling methods, carbon capture and sequestration, biofuels production, wind and solar power generation, and others, will play an increasing role in the global energy mix. But in this climate, what is left for carbon-based fuels?

Despite aggressive carbon reduction goals, a significant market for petroleum products is expected in the future, with near term growth in demand projected by notable analysts over the next decade (understated policy scenarios). The transition of the global transportation fleet to electric power will take several decades, and during this time the increasing standard of living in developing nations will create an increasing need for petrochemicals to support the population. Markets for petroleum-based products, both in transportation and chemicals, are expected to grow while they evolve, into the future.

In parallel to the shifting of energy supply away from carbon-based transportation fuels, refiners have an increasing appetite for processing new, lower carbon feedstocks. Many of these feedstocks present unique processing challenges and require careful consideration for routine / consistent processing outcomes.

With so much transition underway in the world, it is difficult to determine which of the more traditional petroleum fuels (i.e. gasoline or diesel) will be more attractive to refiners in the long term. Local refinery rationalization, crude sourcing, and regional pace of energy transition activity will be important factors. Since it is difficult to predict the long term favored fuel under these conditions, refiners are well served to maintain flexibility in their processes to change production between gasoline and diesel as their markets dictate.

Refiners will face increased levels of competition, and an increasing social pressure to evaluate options to operate efficiently and limit carbon emissions if possible. In this environment, it will be increasingly important to execute projects which drive additional value in the refining system. Among the strongest projects for refineries to consider are projects to upgrade the heaviest fractions of the crude oil (resid processing).

Bunker fuel spec challenges for FCC slurry

The long-anticipated arrival of 0.5 wt% sulfur limit in marine fuels, in keeping with IMO 2020 bunker fuel regulations, was expected by some to severely limit global market outlets for at least 3.3 million bpd of low quality HSFO (> 3.5 wt% S). However, the demand loss from the COVID-19 pandemic, and an unexpectedly high number of scrubber installations on shipping vessels, created a unique market environment in which the value of high sulfur fuel oil exceeded expectations. Presently, this is expected to be a temporary situation, as markets return to a new normal following the pandemic, and in the long term, streams like FCC bottoms will be increasingly hard to blend into VLSFO fuels (but may have a home in the larger than anticipated HSFO products).

Additionally, some HSFO will continue to be needed for power generation and other general uses. Nevertheless, some refiners have invested large sums to reduce refinery HSFO output; One European refiner has already invested more than $600 million to convert its HSFO and other heavy residue to middle distillate and coke, while Kuwait has an ongoing $6.25 billion clean fuels project that involves converting slurry and HSFO to diesel and gasoline.

To manage the challenges for FCC bottoms presented by the IMO regulations, operators have benefitted from customized catalyst solutions using improved diffusion to upgrade slurry into distillate and gasoline. These catalyst solutions additionally upgrade higher quality FCC feeds streams, such as light VGO and LCO to be upgraded to olefins and aromatics. As we move into the future, the business case for slurry upgrading in the FCC system is expected to remain strong.

FCC as an on-purpose C3= machine

Feedstock properties and catalyst formulations no doubt play a role in light olefins maximization from the FCCU. Prior to the new decade, most propylene was being produced from naphtha-based steam crackers and new world-scale propane dehydrogenation units, such as in China, with a smaller fraction (> 30%) coming from high severity FCC units using ZSM-5 based catalysts to increase propylene yields.

However, propylene-configured FCCUs had only been increasing propylene yields to about 11 wt% or less, due to design restrictions and operational constraints (e.g., MAB limits and WGC constraints, etc.). Over the same time, there has been a rapid growth in ethane-based steam cracking capacity in the U.S. Gulf Coast. These new units, however, yield significantly less propylene compared to naphtha-based steam crackers.

This comes at a time when olefins demand going into the new decade is expected to grow between 3.9 to 4.3%, creating the incentive for reconfiguring FCCUs to on-purpose C3= “machines,” requiring high severity operating conditions and olefins conversion catalysts with resilient active sites for processing resids with high metals content (Ni, V, etc.).

Competitive C3= processes

The rapid expansion of shale-based ethane steam cracking capacity along the U.S. Gulf Coast over the past decade yields significantly less propylene than naphtha crackers. This is another reason why C3= yields from FCCUs integrated with petrochemicals are targeting production of C3= up to 20 wt%. Going forward, more FCCs will define primary monetization objectives for the FCCU to include propylene maximization.

Resid conversion to propylene includes refinery grade propylene for the alkylation unit or higher purity grades of propylene for petrochemical feedstock (for efficient upgrading to olefins such as butylene). This provides scale-up opportunities for converting high molecular weight resid feeds, while targeting other business goals, such as bottoms minimization and maximum LPG yield (at constant gasoline production).

Regional stress

European refineries

Western European refineries are particularly exposed to regional stress. Economic models suggest that aging European plants, with utilization rates dropping below 70% by 2023, will rationalize about 2 million bpd of refining capacity by 2025, of which 1.1 million bpd is attributed to the COVID-19 pandemic. Sustained low refining margins as a result of global overcapacity and the low domestic demand will increase the threat of capacity rationalization. Other sites lacking high complexity configurations throughout the world are also at risk.

LATAM refineries

Unlike the global trend, transportation fuels will be the main driver of oil demand growth through 2040 due to population and GDP growth. Larger regional players in South America are expanding refinery capacity by 2022 to capture more value related to local oil production. However, the gap between supply capacity additions and demand will remain, making Latin America to be a net importer of refined products.

American refiners

American refiners have great logistics and low-cost feed availability with utilization rates to remain in the mid- 80s for the foreseeable future. US Gulf coast refiners have used the global transportation fuel market as a source of profitable way using their complexity and low-cost environment to grow utilization in a place where domestic demand was not necessarily growing at the same pace.

In the long term, decrease in domestic demand and new sophisticated refineries coming online—both in countries with growing demand, like China and India, as well as in major oil producing countries in the Middle East are increasing the threat of capacity rationalization for smaller, older and simpler refineries, especially in North America. Therefore, it is important in such a challenging environment to ensure that a refinery asset has both the flexibility and the ability to capture value through different options.

For some facilities, severely hydrotreated feeds can disrupt the unit heat balance in the form of lower regenerator temperature that can be resolved with resid processing. This calls for a catalyst with higher coke selectivity that can lower dry gas production and increase conversion and valuable liquid yield. Engineered solutions will include adherence to removing catalyst circulating constraints and afterburn issues.

Asian refiners

Asian mega refineries benefit from industrialization movements and large populations to support higher demand. Their high-complexity configurations facilitate resid upgrading to fuels and light/heavy naphtha feedstock for petrochemical units (light naphtha to steam cracking & heavy naphtha to aromatics complexes). This model could be duplicated at various levels throughout the world.

From a margin and demand perspective, petrochemicals are surpassing transportation fuels as the largest driver of oil demand, not only in Asia, but throughout the world. Petrochemicals to polymers, plastics, fertilizers, detergents, packaging, clothing, fibers and so many other commodities are why crude oil-to- petrochemicals from the FCC unit can deliver higher margins than fuels.

Before the pandemic, global demand for polymers was expected to reach $693 billion by 2025, according to a recent forecast from Business Wire. This projected growth will require a substantial increase in propylene feedstock for the polymer value chain. For these opportunities, the PropyleneMAX® catalytic cracking technology (PMcc®), a high-severity fluid catalytic cracking process licensed by Technip Energies and jointly developed with W. R. Grace & Co. can provide an increased operating margin (product – feedstock) of as much as $2.60/bbl over traditional operations.

Resid pathways

Flexibility

As refiners seek the flexibility to shift their product portfolio, such as the diesel pool, they benefit from upgrading more challenging opportunity feedstocks. While the FCC unit is well known for its ability to process multiple feedstocks, it has traditionally processed atmospheric and vacuum gas oils (AGOs & VGOs) from the crude distillation unit (CDU).

One of the most value-driven advantages of the FCC process going forward is the flexibility to process complex blends of residues, including atmospheric, hydrocracked and hydrotreated residues. Other feeds that can be processed with unit upgrades and advanced catalyst formulations, include coker and visbreaking gas oils, demetallized oil, etc.

Residue to chemicals

Refiners are assessing options to further upgrade their products into petrochemicals and more valuable chemicals by increasing conversion and/or reconfiguring a refinery to produce more chemicals and ensure higher added value to bottom barrel streams. Conversion by as much as 40% of the resid crude barrel to olefins and aromatics is the current objective for world scale integrated refinery and petrochemical complexes, with higher conversion targets expected by 2023. A tailored catalyst approach, such as RIVE® MHY™ zeolite-based catalyst solution, can provide significant value improvement in this effort.

Residue to profitability

More than 40 resid FCC units (RFCC) have successfully exceeded objectives towards maximizing propylene production. New units and improvements to existing FCCUs are needed to exceed 30% of the global propylene demand from FCC units. Fortunately, technology for efficient resid processing through the FCCU will serve to increase propylene conversion.

Simultaneously maximizing LPG at constant gasoline production is another key objective that can be met with the PropyleneMAX® process. The technology leverages state-of-the-art process and hardware in parallel with industry leading catalyst technology to enable increased resid processing with high propylene yields. More flexibility therefore becomes available for processing a wide range of feedstock from heavy resid to VGO.

The FCCU is truly a dynamic unit operation. When faced with unique operating scenarios and shifting market economics, being prepared to process resid will allow a refiner to remain nimble and maximize the overall profitability of the FCCU operation.