SK Innovation and SK E&S Announce Merger, Forming Asia-Pacific’s Largest Private Energy Company With Assets of KRW 100 Trillion

■ To achieve EBITDA of KRW 20 trillion by 2030 through three major synergies: portfolio, financial/profit Structure, and growth momentum

① Portfolio competitiveness: to establish portfolio competitiveness across all businesses, including current and future energy sectors

② Strengthening financial/profit structure: to secure stable profit generation capabilities in addition to external growth in assets and sales

③ Securing growth momentum: to enhance fundamental competitiveness and foster new businesses through the integration of resources and capabilities

■ To enhance raw material sourcing competitiveness and improve profit structure through the merger of SK On, SK Trading International, and SK Enterm

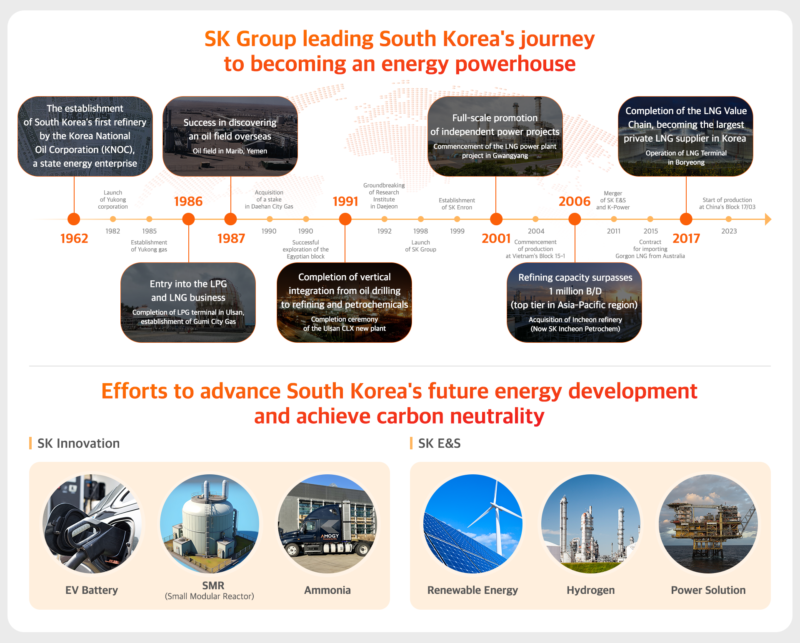

SK Innovation and SK E&S have announced their decision to merge, evolving into a comprehensive energy company that encompasses the entire value chain of both current energy sources (such as oil and LNG) and future energy sources (including renewable energy, hydrogen, and SMR), as well as electrification businesses like batteries and ESS.

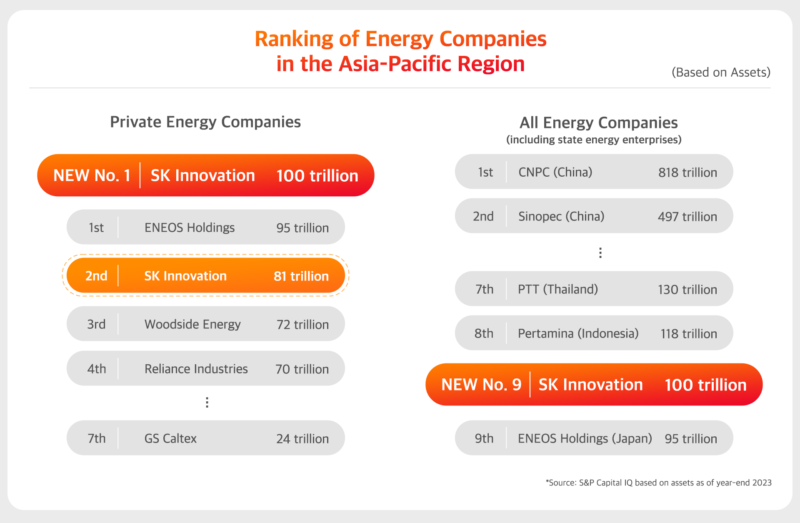

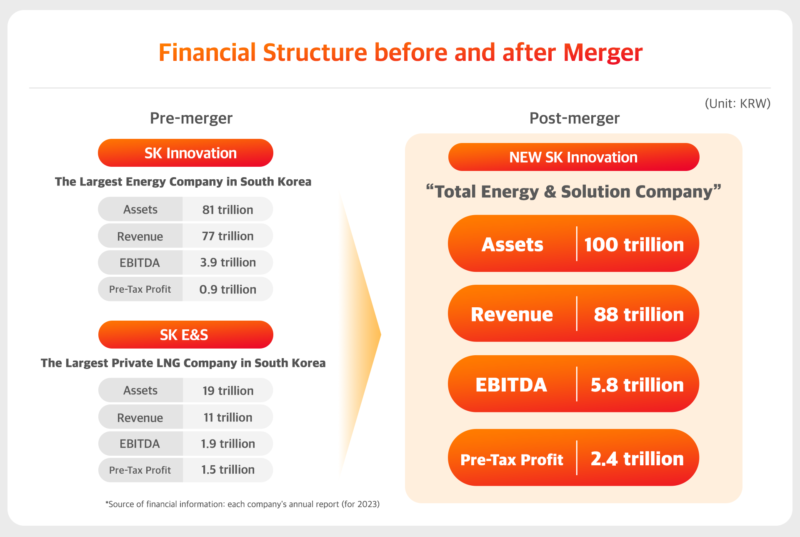

Upon merging, the combined entity will transform into a colossal energy company with assets totaling KRW 100 trillion and revenues of KRW 88 trillion, positioning itself as the largest private energy company in the Asia-Pacific region.

In pursuit of this goal, SK Innovation and SK E&S each held board meetings on the 17th and approved the merger proposal. If the merger plan is approved at the shareholders’ meeting scheduled for the 27th of next month, the merged corporation will officially launch on November 1st.

The merger ratio between the two companies is set at 1:1.1917417, calculated based on the corporate values of SK Innovation and SK E&S. Based on this ratio, SK Innovation, as the listed company, will issue new shares to SK Inc., the shareholder of SK E&S, amounting to 49,769,267 shares. The new shares of SK Innovation are expected to be listed on November 20th, and post-merger, SK Inc.’s stake in SK Innovation is anticipated to increase from 36.22% to 55.9%.

On the same day, SK On, SK Trading International, and SK Enterm each convened their respective board meetings and resolved to merge the three companies.

◈ Evolving into a Total Energy & Solutions Company, leading current and future energy

The merger between the two companies is being undertaken to proactively address the rapidly evolving external business environment, which includes the prolonged global economic downturn, heightened uncertainty in the energy and chemical sectors, and the chasm in the electric vehicle market. Additionally, the merger aims to secure competitiveness in future energy business areas.

SK Innovation was established in 1962 as the first oil refining company in Korea. The company has expanded its business portfolio to include petrochemicals, lubricants, and oil exploration. It is now diversifying into future energy sectors such as electric vehicle batteries, small modular reactors (SMR), ammonia, and immersion cooling, making it the largest energy company in the country.

SK E&S was spun off from SK Innovation in 1999 as a city gas holding company. It has become Korea’s leading private LNG company by completing the LNG value chain on a global scale. The company is transitioning to a green portfolio that organically integrates its four core businesses – city gas, low-carbon LNG value chain, renewable energy, and hydrogen and energy solutions, to create synergies.

The merger is significant as it brings together two companies that have each grown to become the leading players in their respective business areas, solidifying their position as the largest private energy company in the Asia-Pacific region.

Beyond external growth, the merger will generate synergies in three key areas: enhancing portfolio competitiveness, strengthening financial and profit structures, and securing growth momentum.

Firstly, the merged company will develop a comprehensive portfolio that spans all areas, including energy sources (such as oil, chemicals, LNG, city gas, power, renewable energy, batteries, ESS, hydrogen, SMR, ammonia, and immersion cooling), energy carriers, and energy solutions. This will lay a solid foundation for sustainable growth. Currently, global oil majors are also currently pursuing balanced portfolios across the energy sector through various mergers and acquisitions.

Additionally, the merged company will not only achieve a scale of KRW 100 trillion in assets and KRW 88 trillion in revenue but also strengthen its financial and profit structure, with EBITDA* increasing to KRW 5.8 trillion, up 1.9 trillion KRW from pre-merger levels. Notably, the merged company will be able to mitigate the high profit volatility of the petrochemical business, which has served as a reliable cash cow, with the stable profit generation capabilities of the LNG, power, and city gas businesses. An analysis of the pre-tax profit volatility over the past 10 years shows that the merged company’s pre-tax profit volatility will be significantly reduced from 215% to 66%.

*EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization

Furthermore, by integrating assets and capabilities across both energy and electrification sectors, the merged company will bolster its core competitiveness and profitability. For instance, combining SK Innovation’s crude oil refining, crude oil/petroleum product trading, and oil exploration operations with SK E&S’s gas development, LNG trading, and combined cycle power generation will improve the economics and profitability of exploration and development. Additionally, the shared use of infrastructure such as ships and terminals will enable operational optimization.

The electrification efforts pursued by both companies are also expected to gain momentum. SK Innovation has been advancing future energy businesses such as electric vehicle batteries, ESS, and thermal management systems, while SK E&S has focused on distributed power sources like renewable energy and district electricity businesses, as well as hydrogen, charging infrastructure, and energy solutions. The merged company will be able to combine the products and services of both companies to create new business models and pioneer new markets.

The two companies anticipate that by 2030, the synergies from the integration will alone add over KRW 2.1 trillion to EBITDA, aiming for a total EBITDA of KRW 20 trillion.

Park Sang-kyu, CEO & President of SK Innovation, stated, “The merger of the two companies represents a structural and fundamental innovation aimed at achieving sustainable growth by proactively responding to the changing environment surrounding the energy industry.” “Through this merger, SK Innovation will grow into a ‘Total Energy & Solution Company’ that leads Korea’s energy industry from the present into the future.”

Choo Hyeong-wook, CEO & President of SK E&S, commented, “This merger will not only strengthen the existing business capabilities of both companies but also secure growth engines for key future energy businesses.” “Based on the synergies created through the merger, SK E&S will enhance its green portfolio centered on its four core businesses and lead the future energy market.”

◈ Merger in trading and tank terminal businesses to boost SK On’s continued growth

SK Trading International, which has approved the merger with SK On, is Korea’s sole specialized trading company for crude oil and petroleum products. Meanwhile, SK Enterm is the country’s largest commercial tank terminal operator, specializing in the storage and handling of petroleum cargo.

Through the merger of these three companies, SK On will be able to further strengthen its competitiveness in securing raw materials and ensure business sustainability. Additionally, SK Trading International will secure future growth engines by entering new mineral trading fields such as lithium and nickel, while the merger with SK Enterm will provide the necessary storage capacity for its trading business. Most importantly, the merger of the three companies is expected to improve the profit structure by generating an additional KRW 500 billion in EBITDA from the trading and tank terminal businesses.

[Photos]

(Photo 1) The journey of SK in the South Korean energy industry

(Photo 2) Financial structure before and after merger

(Photo 3) Ranking of energy companies in the Asia-Pacific region