Light fuels, heavy impact. How hydroprocessing is bringing new opportunities to Asia’s refiners

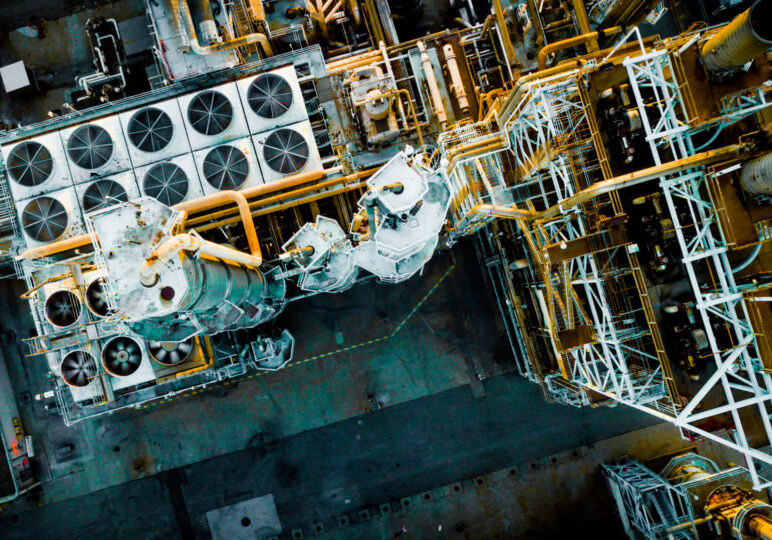

Refiners are cleaning up to face a new era and they are turning to technology to catalyse the process. In a competitive market, with increasing environmental standards and demands for lighter, cleaner fuel products, hydroprocessing has become the unsung hero of the new energy transition: evolving into a critical resource to help operators meet sustainable and business goals.

Asian Downstream Insights shines the spotlight on the next generation of hydroprocessing, the next era of hydrotreating opportunities and catalyst technologies driving commercial success.

New age, new demands, new opportunities

Hydroprocessing – the reaction of oil fractions with hydrogen – is no newcomer to the downstream industry. For almost a century, refiners have been using these catalytic technologies for the production of cleaner fuels. Hydrotreating – the process of adding hydrogen to base oil at temperatures above 600°F and pressures above 500 psi in the presence of a catalyst – has been used in mainstream refining since the 1950’s to remove impurities such as nitrogen, oxygen and sulphur from the base crude. Hydrocracking – a more intense form of hydrotreating using temperatures above 650°F and pressures above 1,000 psi. – followed soon after in the 1960’s.

But a new age has new demands. 2020’s IMO may have passed, quietly eclipsed by the news of the pandemic, but the new regulations, limiting sulphur in vessel fuel to 0.50% m/m, was a symbol of a wider shift towards lower emissions, and higher quality, cleaner products. COVID-19 itself has brought its own set of challenges. With the rise in demand for petroleum-based products, such as petrochemical-derived detergents and plastics, the pressure is on for refiners to upgrade their petroleum heavy crude oil. Hydroprocessing provides an effective means to achieve this. With the continuation of international travel bans, economies are seeing a glut in jet fuel demand, forcing these operators to adapt fast. The chemical similarities between distillate and jet fuel makes this a natural option to consider, and a long-term pause on travel could lead to more distillate being produced, and more hydro-processing units to produce them.

Looking to a long-term future

Advantages of hydroprocessing spread past the pandemic. Many existing downstream unit catalysts are particularly sensitive to feed contaminants, which have the potential to cause temporary or permanent catalyst deactivation. Integrating hydroprocessing into the refining process can help to safeguard these sensitive parts of the refinery units.

What is more, as the market shows a heavy shift towards products such as diesel fuel and naptha, hydroprocessing can help optimize product yield through the treatment of heavy fractions into these lighter, more valuable products. Hydroprocessing technologies can be a valuable tool in keeping a refinery commercially competitive.

Catalysts for a competitive edge

It’s not just about embracing hydroprocessing technology, it’s about choosing the right technology for your refinery’s infrastructure and business needs. The widely different configurations and objectives of each refinery means that no single process technology solution provides a one size fits all.

When choosing a hydroprocessing solution, refiners should perform a thorough technical and economic analysis on-site, keeping in mind that the level of investment will increase according to the unit size and feedstock sulphur levels. Major items of focus should include the operating conditions of the reactor, the number and size of high pressure items and the quantity and quality of catalyst used. This diversity of needs and demands has meant that many solutions providers and operators have kept their process technology development agile.

Acceleration for Asian refiners

Regions will differ as much as refineries, and in the next phase of the hydroprocessing economy, Asia seems set to lead the way. The region is expected to lead the global refinery hydrocracking units’ capacity growth, contributing about 49% of total capacity growth and adding an average of about 1.2 million barrels in daily capacity by 2024.

Next generation supply and demand

The right hydroprocessing technology will fit seamlessly within your refinery’s existing infrastructure, streamlining operations and adding environmental and commercial value with no disruption. But the significance of their impact should not be underestimated, or under-rated.

As global markets cautiously plan their recovery, growing prominence of Middle East crudes will influence a greater presence of medium to heavy feedstocks across the global market. Refinery processes operations must advance and adapt to these next-generation supply and demand chains.

As hydroprocessing becomes more important to maintain a competitive edge in this new market, it’s not just their products, but refinery business leaders too who are under increased pressure. With the right technologies, the end result will be a lighter, more valuable end result. And a robust, more valuable business.

Read more:

- Aramco to Acquire 50% Stake in Air Products Qudra’s Blue Hydrogen Industrial Gases Company

- SK Innovation and SK E&S Announce Merger, Forming Asia-Pacific’s Largest Private Energy Company With Assets of KRW 100 Trillion

- Indorama Ventures Secures $200 Million Loan From IFC to Drive Sustainability Program

- Aramco’s Strategic Gas Expansion Progresses With $25bn Contract Awards

- GC CEO Narongsak Jivakanun Reveals Vision to Continue 3 Steps Plus Strategy and Drive Map Ta Phut to Become Southeast Asia Hub