Keeping an edge in the new downstream

How players maintain economic sustainability in a changing market

The increasing need to reduce the environmental impact caused by fossil fuels has led to a trend of decarbonisation at a global level, creating a new challenge that the crude oil and processing chain must now address.

In this scenario, one available alternative presents itself in the form of raising the participation of renewable fuels in the energy matrix, as well as the increased usage of renewable raw materials in the feed stream of crude oil refineries. This has led to some refining technology licensors dedicating efforts toward the development of processes for this purpose.

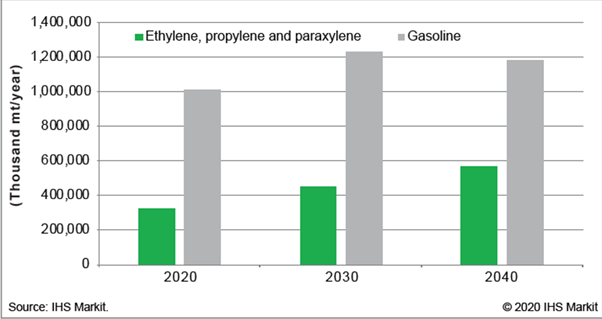

Another deep change in the downstream sector is the trend of reduction in the demand for transportation fuels, accompanied by the growth of the petrochemicals market on a global level. Despite recent forecasts, this demand remains one of the main sources of revenue for the downstream industry, as shown in Figure 1 and based off data taken from IHS Markit Company.

The improvement of fuel efficiency and growing market of electric vehicles has led to a decline in the participation of transportation fuels in the global oil demand. New technology like additive manufacturing (3D printing) has the potential to greatly impact this demand for transportation fuels. In addition to this, the increased availability of lighter crude oils favours the oversupply of lighter derivatives that facilitate the production of petrochemicals against transportation fuels, as well as the higher value of petrochemicals in comparison with fuels.

Like other crude oil derivatives, economic and technological development has led to the increased need for lubricating oils that are of higher quality and performance, with lower contaminant content – which has led to refiners increasing the bottom barrel conversion capacity in order to meet these stricter regulations.

In this scenario, the search for alternatives that ensure the survival and sustainability of the refining industry has only intensified for refiners and technology developers. The maximisation of non-energetic derivatives like lubricants and petrochemicals can offer a profitable alternative to refiners, according to the local market. Due to these similarities, better integration between the refining and petrochemical production processes would appear as a more attractive alternative.

The adoption of synergies between fossil fuels and renewables in the downstream industry is largely dependent on the market where the refiner is involved, and is mainly related to the availability of renewable raw materials, as well as the capacity of the installed refining hardware toward processing renewable streams.

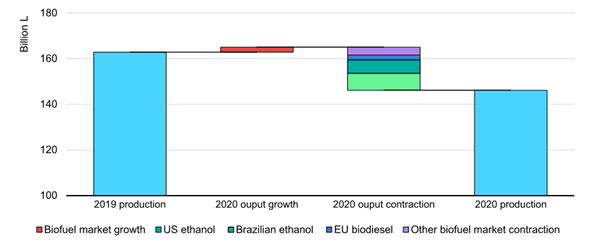

Despite these limitations, it is important to understand that renewables are already a reality in the market, and have contributed to the reduction of the demand for raw fossil material. According to data from the International Energy Agency (IEA), the COVID-19 pandemic has caused the first contraction in the biofuels market in two decades (Figure 2).

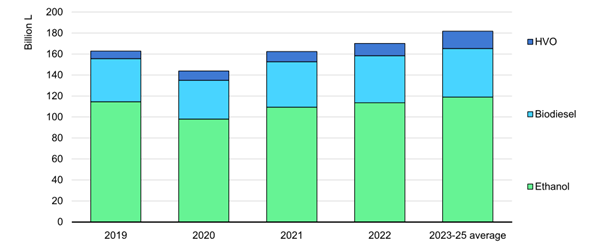

Despite this contraction in 2020, stricter regulations and pressure from policies tend to drive fast recovery and expansion in the demand for biofuels, according to data presented from the IEA (Figure 3).

Considering these trends, it is possible to estimate the impact of biofuels in the crude oil refining industry and the co-processing of renewable raw material in traditional crude oil refineries – which can be an attractive decarbonisation strategy. After the COVID-19 pandemic, some refiners converted remaining assets into renewable raw material, reinforcing this trend in the new downstream industry.

Considering the current scenario and latest forecast, the current competitive positioning in the new downstream industry is sustained by four main pillars:

- Renewables co-processing

- Petrochemical integration

- Higher bottom barrel conversion

- Cleaner hydrogen production routes

Renewables co-processing in crude oil refineries as a decarbonisation strategy

The use of renewable raw material in the crude oil refineries has been discussed over the past few decades. One of the most common processing routes is in the utilisation of vegetable or animal oils in the feedstock of conversion, or treating units to produce high-quality fuels and petrochemicals. This raw material can be directly processed together with fossil streams in conversion units like fluid catalytic cracking (FCC) to produce transportation fuels and olefins.

The use of renewable streams can also be applied as a feed stream for hydrotreating units, in the production of high-quality fuels such as diesel and jet fuel. Some refiners and technology licensors have even developed process technologies that make it possible to achieve a higher synergy of renewables with the traditional refining industry.

In the petrochemical sector, the production of petrochemical intermediaries has also adopted processing routes for renewables – such as turning ethanol into ethylene. As an example, the Braskem Company has been producing ethylene through ethanol dehydration since 2010, and some technology licensors have been developing processing routes solely dedicated to producing ethylene from ethanol.

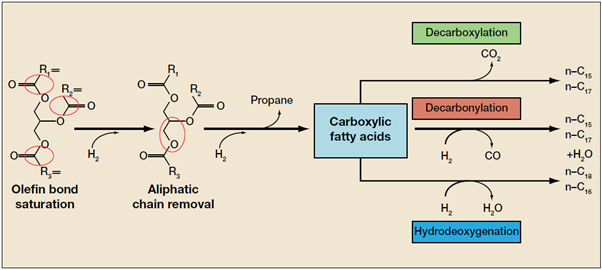

Despite the advantages of reducing the refining industry’s environmental footprint, renewables processing presents various technological challenges for refiners. Figure 4 shows the chemical mechanism for the processing of vegetable/animal oils in hydrotreating units.

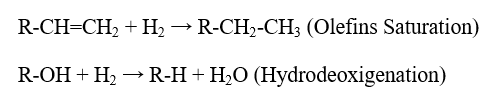

The renewable streams show a great number of unsaturations and oxygen in the molecules, which leads to high heat release rates and hydrogen consumption – which then leads to the necessity of increased heat removal from hydrotreating reactors so as to avoid damaging the catalysts. The main chemical reactions associated with the hydrotreating process can be represented as such:

Where R represents a hydrocarbon.

These characteristics have led to the necessity of higher hydrogen production capacity, as well as more robust systems for hydrotreating reactors, and in some cases, the reduction of processing capacity to absorb the renewable streams.

At this point, it is important to consider a viability analysis related to the use of renewables in the crude oil refineries, as the increased necessity of hydrogen generation implies higher CO2 emissions through the natural gas reforming process (which is the most-applied process in hydrogen production on a commercial scale).

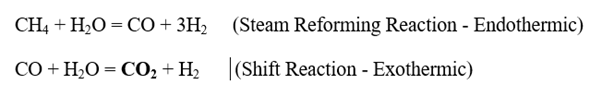

Figure 5 shows the evolution of demand for hydrogen in the refining industry over the past few years. This growing demand is strictly related to the improvement of hydroprocessing capacities by refiners who are aiming to meet environmental regulations.

Despite concerns related to CO2 emissions due to hydrogen production, there are cleaner routes of hydrogen production that present attractive alternatives to downstream players. These include biomethane steam reforming, reverse water gas shift (RWGS), and electrolysis.

As previously mentioned, the renewable streams show a great number of unsaturations and oxygen in the molecules, which leads to high heat release rates and hydrogen consumption – which then leads to the necessity of increased heat removal from hydrotreating reactors so as to avoid damaging the catalysts.

This leads to the necessity of higher hydrogen production capacity from the refiners, as well as making quenching systems of hydrotreating reactors more robust, or in some cases reducing the processing capacity when it comes to absorbing renewable streams.

This has also led to some technology licensors dedicating efforts toward looking for alternative routes of hydrogen production on a larger scale and in a more sustainable manner. Some alternatives include:

- Natural gas steam reforming with carbon capture

- Natural gas steam reforming applying biogas

- Reverse water gas shift reaction (CO2 = H2 + CO)

- Electrolysis

Hydrogen is a key enabler to the future of downstream, and the development of renewable sources is fundamental to the success of transitioning energy to a lower carbon profile. In the current scenario, the best alternative for refiners is to optimise hydrogen consumption, as well as minimise operating cost and CO2 emissions.

Another challenge associated with renewables processing is the cold start characteristic of the derivatives, mainly for diesel and jet fuel. Renewable feed streams produce highly paraffinic derivatives after the hydrotreating step as described in Figure 1, and in this sense the final derivative tends to show a higher cloud point which can be a severe restriction in colder markets such as the northern hemisphere.

In these markets, refiners tend to apply catalytic beds containing dewaxing catalysts (ZSM-5) in hydrotreating units or cloud point depressors additives, which can raise the operation cost.

Hydrotreated Vegetable Oil (HVO): An attractive route to reach “green diesel”

The necessity to build a continuous supply of more sustainable transportation fuels has led refiners to continue processing renewable raw materials and in refining hardware to achieve cleaner fuels with less carbon. One of the most promising initiatives is the production of hydrotreated vegetable oil (HVO) in some refineries.

This process consists of processing renewable material like palm oil in conventional diesel hydrotreating units to produce what is known as “green diesel”. Biodiesel is produced through transesterification, producing a mixture of fatty acids and methyl esters, while HVO is composed of normal paraffin, which is the result of hydrotreating reactions.

One advantage of HVO in comparison with biodiesel is the similarity of properties in relation to fossil diesel – HVO density tends to be lower than fossil diesel, and with a high cetane number is a perfect additive to final mixtures. On the other hand, the high concentration of normal paraffin leads to worse cold flow characteristics, which can be bypassed through the use of dewaxing beds in hydrotreating reactors applying ZSM-5 catalysts to control the dimensions of paraffin chains. Due to these characteristics, HVO is a better blending agent for final diesel, instead of traditional biodiesel produced by transesterification.

One of the biggest challenges of HVO production is the type and cost of raw material that must be used, as well as the catalyst that is applied in the process. Hydrotreating catalysts are usually composed of metal sulfide such as NiMo or CoMo carried over Alumina, but the low sulfur concentration and water production during the hydrotreating reaction of renewable raw materials tend to deactivate these catalysts.

In this case, an alternative would be to feed H2S with the feed stream, but there is always the risk of contaminating the final derivative with high sulfur content. The use of noble metals like Ru and Pt as active metals may solve this problem, but the operating costs may prove to be prohibitive.

Yet another challenge related to HVO production is the higher heat release in hydrotreating reactors, which requires a well-dimensioned quenching system. It is important to remember that conventional hydroprocessing reactors are designed to deal with low contaminant concentration while renewable raw materials present a high quantity of unsaturated molecules and oxygen, leading to a high heat release rate as shown in Figure 4.

Another issue related to the coprocessing of renewable raw materials in crude oil refineries is the tendency toward water retention in the final derivatives. Due to its chemical structure, biodiesel tends to retain over eight times more moisture than fossil diesel, which can lead to issues like microbiological degradation of the fuel in transport and storage systems. The soluble water content in pure biodiesel can reach up to 1.800ppm while the value of diesel with 20% biodiesel can reach up to 280ppm of soluble water, and diesel containing 5% biodiesel can reach up to 150ppm – this will lead to refiners adjusting their hardware to allow for water removal from final derivatives, applying draining systems or salt filters to control moisture content in the final derivatives.

From a crude oil producer’s point of view, renewable coprocessing can be faced as demand destruction. This threat can be overcome through enjoying the change in the profile of crude oil consumption, where a growing demand for petrochemical intermediaries – like ethylene, propylene and BTX – and a falling demand for transportation fuels like gasoline and diesel have been observed.

Petrochemical maximisation: A nobler, cleaner purpose for crude oil

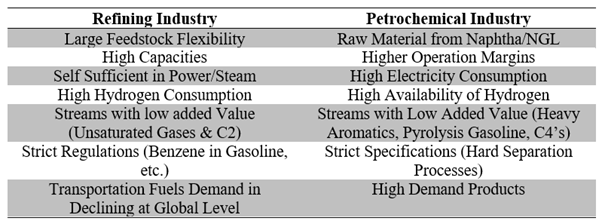

The main focus of closer integration between refining and petrochemical industries is to promote and seize the synergy’s existing opportunities between both downstream sectors to generate value for the entire production chain. Table 1 presents the main characteristics of the refining and petrochemical industry and the synergy’s potential.

As previously mentioned, the petrochemical industry has been growing at a considerably higher rate as compared to the transportation fuels market over the last few years, and represents less environmental aggression toward crude oil derivatives. The technological bases of the refining and petrochemical industries are similar, which has led to possibilities of synergies capable of reducing operational costs and adding value to derivatives produced in refineries.

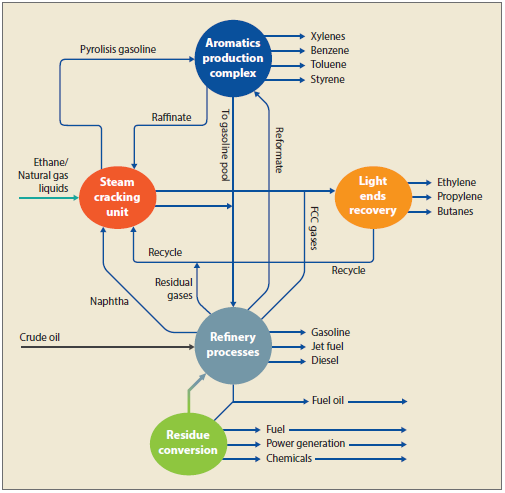

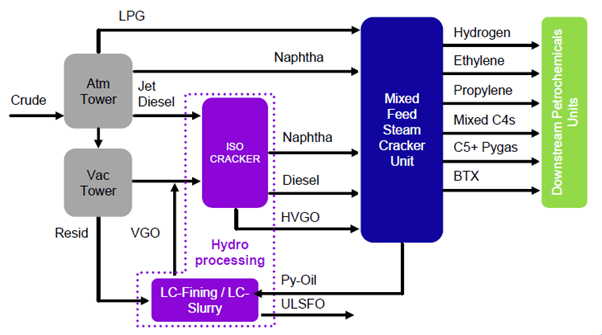

Figure 6 represents a block diagram that shows the possibilities of integration between refining processes and the petrochemical industry.

Process streams considered to have low added value to refiners are attractive raw materials to the petrochemical industry, and streams considered to be residual to petrochemical industries can be applied to refineries to produce high-quality transportation fuels, which can help the refining industry to meet environmental and quality regulations.

The integration potential and synergy in these processes relies on the refining scheme adopted by the refinery and consumer market, as process units such as fluid catalytic cracking (FCC) and catalytic reforming can be optimised to produce petrochemical intermediaries to the detriment of streams that will be incorporated into the fuels pool.

In the case of FCC, the installation of units dedicated to producing petrochemical intermediaries (called petrochemical FCC) aims to reduce the generation of streams in producing transportation fuels to their absolute minimum. However, the capital investment for this is high, and the severity of the process requires the use of material with the noblest metallurgical properties.

The crude oil to chemicals strategy

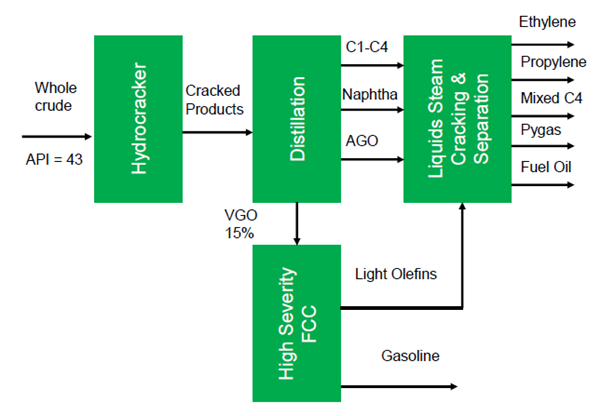

Due to the increasing market and higher added value, as well as the trend of reduction in demand for transportation fuels, some refiners and technology developers have dedicated efforts toward developing crude and turning it into chemical refining assets. For Saudi Aramco Company, this concept is based on the direct conversion of crude oil to petrochemical intermediaries as presented in Figure 7.

This process is based off the quality of the crude oil and deep conversion technologies, like high severity or petrochemical FCC units and deep hydrocracking technologies. The processed crude oil is light with low residual carbon that is a common characteristic in Middle Eastern crude oils, and the processing scheme involves deep catalytic conversion processes aiming to reach maximum conversion to light olefins. In this configuration, the petrochemical FCC units have a key role to play in ensuring high added value to the processed crude oil.

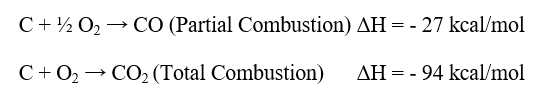

To petrochemical FCC units, the reaction temperature reaches 600⁰C, and higher catalyst circulation rate raises the gases production, which requires a scaling-up of gas separation sections. The higher thermal demand makes the operation of the catalyst regenerator in total combustion mode more advantageous, leading to the necessity of installation in a catalyst cooler system.

The installation of petrochemical catalytic cracking units requires a deep economic study, considering the high capital investment and higher operational costs. However, some forecasts indicate growth of 4% per year until 2025 for the market of petrochemical intermediaries. In this scenario, capital investment will allow a favourable competitive positioning for the refiner, through the maximisation of petrochemical intermediaries.

In refining hardware with conventional FCC units, further than the higher temperature and catalyst circulation rates, it is possible to apply the addition of catalyst additives like the zeolitic material ZSM-5, which can raise the olefins yield close to 9% in some cases when compared to the original catalyst. This alternative raises operational costs, however, and can only be economically attractive when considering petrochemical market forecasts.

The installation of catalyst cooler systems raises the process unit profitability through the total conversion enhancement and selectivity to nobler products such as propylene and naphtha against gases and coke production. The catalyst cooler is necessary when the unit is designed to operate under total combustion mode due to the higher heat release rate as presented below:

In this case, the temperature of the regeneration vessel can reach values close to 760⁰C, leading to higher risk of catalyst damage which is minimised through catalyst cooler installation. The option that the total combustion mode will need to consider is that the refinery’s thermal balance will, in this case, not be able to produce steam in the CO boiler. Furthermore, the higher temperature in the regenerator require materials with the noblest metallurgy, which significantly raises the installation cost of these units – which can then be prohibitive to some refiners with restricted capital access.

Some technology developers have dedicated efforts toward improving steam cracking technologies over the years, especially in relation to steam cracking furnaces. One of the best-known steam cracking technology is the short residence time (SRT) process, developed by Lummus Company, that applies a reduced resistance time to minimise the coking process and ensure a higher operational life cycle.

Cracking reactions occur in the furnace tubes, and one main concern and limitation to the operating life cycle of steam cracking units is the formation of coke in the furnace tubes. These reactions are carried out under high temperatures of between 500-700⁰C, according to the characteristics of the feed (inlet temperature). For heavier feeds like gas oil, lower temperatures are applied to minimise coke formation – this combination of high temperatures and low residence time are the main characteristics of the steam cracking process.

Technology developer have been focusing efforts on developing commercial crude-to-chemicals refineries. Figure 8 presents the concept of the crude-to-chemicals refining scheme by Chevron Lummus Company.

As shown in Figure 8, production has changed to focus on the maximum added value to crude oil, through the production of high added-value petrochemical intermediaries or general-purpose chemicals, leading to a minimum production of fuels. Big industry players such as Saudi Aramco Company have made great investments in COC technologies, aiming to achieve even more integrated refineries and petrochemical plants – which then raises their competitiveness in the downstream market.

Recovering more from crude: Deep bottom barrel conversion technologies

When it comes to the downstream of the future, one fundamental pillar comes from the capacity to add value to bottom barrel streams, recovering maximum value from each molecule. Residue-upgrading technologies are fundamental to refiners, especially for those who process heavy and high-contaminant crude oils. Despite the relative low cost of technologies based on carbon rejection principles, these processes present some limitations and highly competitive refiners tend to opt for technologies based on hydrogen addition principles to process heavier crudes. In this scenario, the most effective residue-upgrading technologies are hydrocracking processes.

Despite high performances, fixed-bed hydrocracking technologies are not always economically effective in treating residue from heavy and extra-heavy crudes, due to their short operating life cycle. Technologies that use ebullated bed reactors and continuum catalyst replacements allow for higher campaign periods and conversion rates. Among these technologies, the best-known are the H-Oil and Hyvahl technologies developed by Axens Company, the LC-Fining Process by Chevron-Lummus, and the Hycon process by Shell Global Solutions. These reactors operate at temperatures of above 450⁰C and pressures of up to 250 bar.

Catalysts applied in hydrocracking processes can be amorphous (alumina and silica-alumina) and crystalline (zeolites), and have bi-functional characteristics once the cracking reactions (in the acid sites) and hydrogenation (in the metals sites) occurs simultaneously.

One improvement made in relation to ebullated bed technologies is the slurry phase reactor, which can achieve conversions at a rate of above 95%. In this case, the main technologies available are:

- The Hydrocracking-Distillation-Hydrotreatment (HDH) process, developed by PDVSA-Inteve

- The VEBA-Comicracking Process (VCC), commercialised by KBR Company

- The Eni Slurry Technology (EST) process, developed by Italian state oil company ENI

- The Uniflex technology, developed by UOP Company

In the slurry phase hydrocracking units, catalysts are injected with feedstock and activated in-situ while the reactions are carried out in slurry phase reactors, minimising reactivation issues and ensuring higher conversions and longer operating life cycles.

As an example: To meet new bunker quality requirements, noblest streams, which are normally directed at producing middle distillates, can be applied to produce low-sulfur fuel oil. This can lead to a shortage of intermediate streams to produce these derivatives, which then leads to a raising of prices.

The market of high-sulfur-content oil should be strongly reduced, due to the higher price gap when compared to diesel. Production also tends to be economically unattractive, and in these cases deep hydrocracking technologies can help refiners to meet new regulations with low degradation of noblest derivatives.

Conclusion

The energy transition is not a question of choice for the players of the downstream, industry; it’s a demand from society, and a question of survival in the long-term. Decaronisation of the energy matrix requires even more flexibility and agility from refiners aiming to keep and improve their refining margins in the scenario of reduced demand for transportation fuels and growing demand for petrochemicals. However, there are available processing technologies that are capable of allowing the co-processing of renewables and fossil feed streams in crude oil refineries, reducing the environmental impact of the downstream industry.

Even today, it is still difficult to imagine the global energy matrix free of fossil transportation fuels, especially for developing countries – and raising the participation of renewable raw material in crude oil refineries can be an attractive strategy.

Another significant trend capable of producing disruptive changes in the crude oil refining industry is the increased integration with petrochemical assets. Recent forecasts and growing demand for petrochemicals, as well as the pressure to minimise the environmental impact caused by fossil fuels, have created a positive scenario and acted as a main driving force for closer integration between refining and petrochemical assets. In extreme scenarios, the zero-fuels refineries will grow in the medium term, especially in developed countries.

The production of petrochemicals can ensure more added values for crude oil reserves, as well as a look at noble streams as a finite resource. Furthermore, this will minimise the environmental impact caused by the crude oil processing chain. In this sense, the concept of zero-fuel refineries can be an attractive alternative in the future of the downstream industry. Additionally, the maximisation of non-energy derivatives such as lubricating base oils can ensure higher revenues and participation in a growing market for refiners with adequate refining hardware, as an adequate response to falling demand for transportation fuels, and the necessity to reach more added value to processed crude.

In summary, the downstream of the future will be based on four main pillars:

- Petrochemical integration

- Renewables co-processing

- Clean hydrogen generation routes

- High bottom barrel conversion capacity

The refiners capable of integrating these characteristics will have a significant competitive advantage in the downstream market, especially as digitalisation technologies will grow as a fundamental part of supporting downstream operations.

References

CHANG, R.J. – Crude Oil to Chemicals – Industry Developments and Strategic Implications – Presented at Global Refining & Petrochemicals Congress (Houston, USA), 2018.

CHARLESWORTH, R. Crude oil to Chemicals (COTC) – An Industry Game Changer? IHS Markit Company, Presented in 14th GPCA Forum, 2019.

Deloitte Company. The Future of Petrochemicals: Growth Surrounded by Uncertainties, 2019.

HILBERT, T.; KALYANARAMAN, M.; NOVAK, B.; GATT, J.; GOODING, B.; McCARTHY, S. – Maximising Premium Distillate by Catalytic Dewaxing, 2011.

IEA, “Global demand for pure hydrogen, 1975-2018“, IEA, Paris https://www.iea.org/data-and-statistics/charts/global-demand-for-pure-hydrogen-1975-2018

MUKHERJEE, U.; GILLIS, D. – Advances in Residue Hydrocracking. PTQ Magazine, 2018.

Reinventing the Refinery through the Energy Transition and Refining-Petrochemical Integration. IHS Markit, 2020.

ROBINSON, P.R.; HSU, C.S. Handbook of Petroleum Technology. 1st ed. Springer, 2017.

ZHU, F.; HOEHN, R.; THAKKAR, V.; YUH, E. Hydroprocessing for Clean Energy – Design, Operation, and Optimization. 1st ed. Wiley Press, 2017.

About the author

Dr. Marcio Wagner da Silva is a Process Engineer and Project Manager focusing on Crude Oil Refining Industry, and is currently based in São José dos Campos, Brazil. He also has a Bachelor in Chemical Engineering from University of Maringa (UEM), Brazil and PhD. in Chemical Engineering from University of Campinas (UNICAMP), Brazil.

Dr. Marcio Wagner has extensive experience in research, design and construction to oil and gas industry including developing and coordinating projects to operational improvements and debottlenecking to bottom barrel units. Moreover, Dr. Marcio Wagner has an MBA in Project Management from Federal University of Rio de Janeiro (UFRJ), in Digital Transformation at PUC/RS, and is certified in Business from Getulio Vargas Foundation (FGV).