Interview with Daniel Raj David, CEO & Cofounder, Detect Technologies, India

There’s so much innovation happening in the oil & gas sector. Before we dig into your outlook on the sector and what’s on the horizon, tell us how you got involved in the industry and some more about your organization Detect Technologies.

While working in the industry, we often saw gaps in processes and management. One particular realisation that would cause Detect Technologies’ inception was seeing how pipeline health was being monitored. Being the most critical assets in the oil and gas industry, a slight miss in pipelines could result in production loss, major safety issues, and even death. Despite the rapid advancement of technology, managing pipelines was still a reactive activity or required turnarounds. This was solvable – we could move to a more proactive approach. So, we brought together some brilliant people to build GUMPS™ – a first-of-a-kind, patented, and fully automated, long-range pipeline sensor that could monitor pipeline integrity at high temperatures in real-time. And the rest is history.

With every new customer, we moved closer to a shared mission – to reimagine global industrial productivity, and thus, our tech-intensive knowledge and innovations resulted in several globally adopted solutions. We brought some of the brightest talents to solve the most challenging problems across industries, with a vision to digitalise three crucial pillars of the value chain in industries – people, equipment, and processes. Capabilities like end-to-end automation in tasks, predicting failures in equipment and machinery, and automating safety compliance, among others, were set to define the future of all industries.

Today, our innovative portfolio disrupts the downstream industry and brings end-to-end automation to processes for industry giants and Fortune 500 enterprises. Detect Technologies beautifully combines several technological fields like artificial intelligence, machine learning, IoT, mobility, software, and edge computation to achieve optimum industrial productivity for industries like renewables, oil and gas, construction, pharmaceuticals, steel, fertilisers, and more.

Our solutions are all working towards maximising safety, efficiency, and productivity and eliminating industrial downtimes. To name a few – T-Pulse™ is an end-to-end industrial project management solution that automates daily operations, shutdowns, turnarounds, construction projects, outages, and more, by pushing the boundaries of visual intelligence. It brings complete automation to safety, productivity, and resource allocation through state-of-the-art visual and contextual data. Noctua™ is a one-stop solution for complete automation of equipment health monitoring ranging from static assets to rotary and electrical assets without any manual intervention.

Detect Technologies is revolutionising the global industrial landscape by solving age-old industrial constraints and spearheading this domain with new applications and possibilities that are being adopted globally. I am proud of the innovative portfolio that Detect has built over the years, that is being used in 100+ sites in India, Singapore, Indonesia, Canada, the USA, Middle East, among others. Our global customers include Shell, ExxonMobil, Aramco, Reliance, Indian Oil, BPCL, LNG Canada, Vedanta, Adani, and more.

What is the main driver influencing change across the future of the downstream industry?

Over the past 60-70 years, the downstream industry has seen gradual improvements and upgrades, consistent with the changing needs of its customers. The uncertainties that affected businesses were primarily influenced by political, geographical, and environmental factors. The last few years brought digital disruption that completely changed this narrative. The shale oil revolution and significant gas finds in different parts of the world initiated a paradigm shift for the downstream industry.

A primary driver that set the ball rolling for some big changes was the increasing focus on climate change and its impacts. Sustainability and decarbonisation have become key concerns that led to a greater interest in natural gas as a friendlier fossil fuel. Further, rapid advancement in technologies brought alternatives in the form of green biofuels, renewable energy sources, electric vehicles, and more. Green hydrogen is being pursued as an alternative fuel, and there are plans for developing commercial technologies for the same.

A combination of all these events is disrupting the conventional downstream business. While the crude oil demands may be reducing, it will continue to be the primary energy source in the foreseeable future. The reduction in diesel demands and the advent of Oil-to-chemical technologies to meet the burgeoning petrochemical demands dramatically influence the downstream industry. The resultant VUCA environment is redefining business needs.

Now, sustainable operations, optimisation of capital assets, efficient supply change management, intelligent asset integrity management and utilisation, etc., are day-to-day focus points for CXOs. While these were previously being looked at as tools for gradual improvement, the urgency to achieve swift and decisive enhancement coincided with the digital revolution. The use of IIoT, cloud computing, advanced analytics with AI/ML, and robotics – has created immense opportunities to remain relevant and competitive in this changing world. Ironically, COVID-19 was a driving force for most successful CXOs to accelerate their initiatives and bring rapid digital transformation for future growth.

What do you think the shape of post-pandemic recovery looks like for Asia and other regions across the world?

I remain optimistic about the overall economic recovery in major parts of the world, including Asia. The more developed nations with their access to vaccines appear to get back on the path of recovery. The systematic use of reserves globally, combined with faster digital adoption, has helped the industry slowly recover to the pre-COVID trajectory.

In India, for instance, the stabilisation of the vaccine strategy drove stock markets through a prolonged bull run. India has also been the front-runner in adopting many digital and automated solutions, which has led to many industries posting their best-ever results this year. The downstream industry, which saw depressed demands, is now seeing rapid growth in gasoline demand. Experts foresee a resurrection of diesel demands by the end of the year.

The pandemic has rewritten the way the world does business. COVID-19 has sped up digital transformation by several years, and technologies are crucial in disrupting the situation created in the pandemic. While the shape of the economic recovery curve may vary from country to country, the gradual return to the normal, albeit a new normal, is on.

How will new technologies help shape the recovery of the oil and gas downstream industry?

We are witnessing an unparalleled level of disruption in the downstream industry. The rate at which the industry needs to recover, not only to its original pre-pandemic path but towards a new and improved normal, will be governed by its swiftness to adapt to changing needs. The pandemic has been a catalyst for this transformation and pushed to bring fundamental change with technology.

New technologies are rapidly emerging and evolving, and their commercialisation provides new opportunities for the downstream sector. While there has been a continuous emergence of alternatives to fossil fuels, the oil industry remains relevant. In order to be competitive, the industry needs to remain agile and dynamic.

Digital interventions have delivered results to help shape the path to recovery. Some of our solutions at Detect Technologies have helped the downstream industry sustain their processes and reconfigure their digital roadmap during the pandemic. Our technologies have helped in optimising costs, maintain asset integrity with remote monitoring, enhancing efficiencies, and in some cases, providing secure environments for the sustenance of business.

T-Pulse™, for example, has helped our clients achieve a reduction in turnaround time, creating value by saving millions of dollars. It created possibilities in situations where the skilled workforce was limited, and margins were squeezed. It is apparent that legacy companies that were slow in digital adoption are now reinventing themselves and are on their path to recovery.

The pandemic is an unprecedented situation, and responding to this has been a herculean task for this industry – but with this came a new age of opportunity for not just recovery, but radical transformation.

What metrics are available for operators to prove the ROI of implementing digital technologies?

Digital transformation is vital for differentiated stakeholder experience, and determining ROI is essential to scale up any solution deployed at a site. From our experience in bringing digital interventions in areas like advanced work packaging, industrial safety, workforce productivity, schedule control, and operations – it is evident that vendors/operators need to work closely with clients to set the expectations on the exact value they bring in. At Detect, we aim to go beyond client expectations.

For instance, we deployed T-Pulse™, our end-to-end project management solution, in one of the largest construction facilities in the world. The aim was to bring down violations, incidents, and near misses occurring at the site at any given point and drive Goal Zero. Before we start rolling out the technology, the most important first step for us is to identify the previous benchmarks in the facility, like the average number of safety violations observed per day. Let’s assume that this number is X. Within 5 days of the rollout, we could see that the violations per day were 4 times what was previously observed. T-Pulse™ was able to identify many more violations than were expected. Subsequently, within 30 days, with complete visibility and awareness of all activities, these violations were reduced by 70-80% with real-time interventions.

This led to global scale-out programs with associated facilities. Not just that, after benchmarking, we could also measure other parameters like active work hours, productivity, speed of the project, and more. So, while different digital technologies could have different ROI metrics, setting clear parameters and benchmarks through unified data are key to drive and prove ROI. Operators must slow down and think methodically about projects, build an ROI model that tracks all pertinent metrics, and go one step further to deliver more.

In your opinion, how can refiners best capture the benefits of the energy transition?

Most of the top oil and gas enterprises worldwide are focusing on energy transition, and existing refiners are following suit. This is pushing them to make more with less, which is possible today, with hundreds of technology companies innovatively focusing on reducing the carbon footprint and environmental impact.

New technologies are being deployed across the industrial ecosystem to monitor flares, emissions, smoke, and more. While these were once ‘nice to have’ technologies, they have slowly become must-haves across all refiners. Similarly, an active drive towards EHS and HSE across organisations has become paramount to scores of organisations. Easy to plug-in digital technologies that drive this without losing focus on automation and integration are vital in supporting this transition.

It is an opportune time for refiners to build futureproof strategies to navigate energy transitions and leverage innovative digital solutions.

What role will vertical integration between downstream, midstream and upstream play in the next normal of the oil and gas downstream industry, and how does that link into digital transformation?

Vertical integration has existed between upstream, midstream, and downstream for a long time. Most major players in the oil and gas industry have been vertically integrated companies traditionally. In the recent past, enhanced volatility and disruptions have increased the need to consider this strategy.

Many of the stand-alone refineries have closed when margins have been squeezed. Oil exploration efforts were shut down when the market saw a slump in crude oil prices. So, wherever possible, especially companies with deep pockets, consider this siloed strategy as a constraint against the performance of other sectors. In the current environment, all national oil companies are working towards being vertically integrated.

Digital transformation brings transparency and availability of data in a holistic fashion. It helps identify gaps and creates opportunities between verticals, whether it is capital investment optimisation, supply change management, or asset or human capital management. Employment of predictive analytics or AI enables consistent and efficient optimisation and improvements across the value chain for enhanced productivity and production. More and more companies are using digital technologies to break informational and operational siloes and bring value across all the company’s verticals.

One of the biggest challenges the market faces is equipping the workforce to adapt to the pace of digitalisation. How could refiners empower their workforce to adapt to the digitalisation strategies needed to survive and thrive in the new normal?

Digital transformation is a strategic change for businesses to pivot their services and stay relevant and competitive. This requires well-chartered change management strategies to get the support of the workforce. Empowerment starts with effective communication with the workforce on these strategies and training plans. Refiners need to take a people-first approach, and without losing focus on transition, empower people with the right mix of skills like cognitive skills, IQ, EQ, etc., to succeed in a digital environment.

Learning and development efforts should also be of high priority. Competency mapping, finding more learning opportunities, and creating a learning organisation culture is essential to thriving in the new normal. Developing digital tools to re-skill and upskill with appropriate incentives could push the envelope to these digitalisation strategies. Management and labor policies could also be created reviewed with the future of the downstream industry in mind.

It is essential to look at digital transformation as a continuum and involve the workforce through different facets to adapt truly.

How can digitalisation/new technologies help organisations reach their sustainability goals?

Digitalisation and new technologies are increasingly focused on improving efficiency, optimising the use of resources or raw material, controlling environmental emissions, conserving natural resources, among other applications. In the oil and gas industry, digital plays an integral part in collecting and analysing data to generate actionable recommendations for added transparency and data-backed decision-making.

While digitalisation brings multiple disparate elements together to paint a complete picture for better decision making, this visibility also helps in ensuring human and process safety, energy conservation, asset integrity and capital management, emission monitoring and control, water conservation, and a lot more. We can see how new technologies reduce carbon and other chemical emissions, pay attention to groundwater build-up, conserve natural resources, and protect humankind from hazardous impacts. They inevitably help organisations reach sustainability goals.

A lot of the solutions from Detect Technologies are focused on sustainability. Our clients have automated flare monitoring, corrosion detection, HSSE compliance and are on their path to achieve Goal Zero.

How can operators get started if they want to employ the digital twin concept?

Digital twins are at the core of this industrial revolution, and the opportunities they bring are endless. They mirror the exact state of a physical system to provide a dynamic digital representation of it. To build a digital twin, we need two essential parts to run in tandem – a model describing the behaviour of the physical twin and sensors that provide real-time coupling to the model.

The digital twin concept lets the operator monitor a manufacturing component, asset system, or processes and can be used for getting a deeper understanding of the dynamics of the asset under consideration. Typically, in the oil and gas industry, digital twins are used for real-time monitoring, predictive maintenance, asset integrity management, accelerated risk assessment, and intensive training. Based on the operator’s needs and end application, the digital twin can be built through third-party or internal applications.

First, operators must spend time understanding their needs and end-applications of digital twins. The twins can initially be tested offline and then connected with physical systems for achieving end objectives and accelerating operational and strategic decision-making. Operators can also assimilate digitalisation into their operations by learning from the first movers of the world – who are effectively maximising productivity and asset uptime. 3D reconstructed models and models made from 2D drawings, coupled with data from IoT sensors, are gaining importance today and make it possible to pinpoint the location of any observation and help operators navigate through specific areas effortlessly.

How important is culture when implementing AI into the business infrastructure? And what can business leaders do to ensure that AI is accessible and understood across all parts of the business?

Like with any new technology, especially one that alters the way work is done, implementing AI into a business requires excellent change management efforts to overcome natural organisation resistance and change the status quo.

The ultimate goal of implementing AI into the business infrastructure would be to enhance operational efficiencies, build better customer relationships, and assist people on-ground to get more real-time insights. To achieve this, decision-making needs to be data-oriented, and organisations need to encourage continuous innovation.

The business leaders can only support necessary transitions to bring evolutionary change – people need to want to change too. It is imperative to bring a cultural shift by breaking down the team and operational siloes and digitally bringing everyone on the same team.

Achieving such transitions require being transparent and rewarding continuous improvement and learning. Effective and sustained communication through learning processes is essential. For an initiative to be successful, corporate plans should consider individual employees’ contributions and create sustained motivations and incentives for support. Business leaders should develop a high-performance culture to achieve operational excellence.

As digital technologies are increasingly introduced into operations, in what way will they improve energy sustainability?

Several digital technologies are focused on efficiency improvement programs related to better use of fossil fuels, energy conservation, minimising unwanted emissions, optimising process operations, among others, all of which contribute to energy sustainability. Moreover, digital advances are bringing more attention to enhancing renewable energy, green fuel production, and other applications that contribute to energy sustenance.

For instance, one of our solutions at Detect Technologies has automated flare monitoring – where the reaction time to control a smoke or flare release in the environment is controlled through an intelligent algorithm, providing real-time insights to the operator. This has proved to be a very effective tool to reduce carbon emissions on-site.

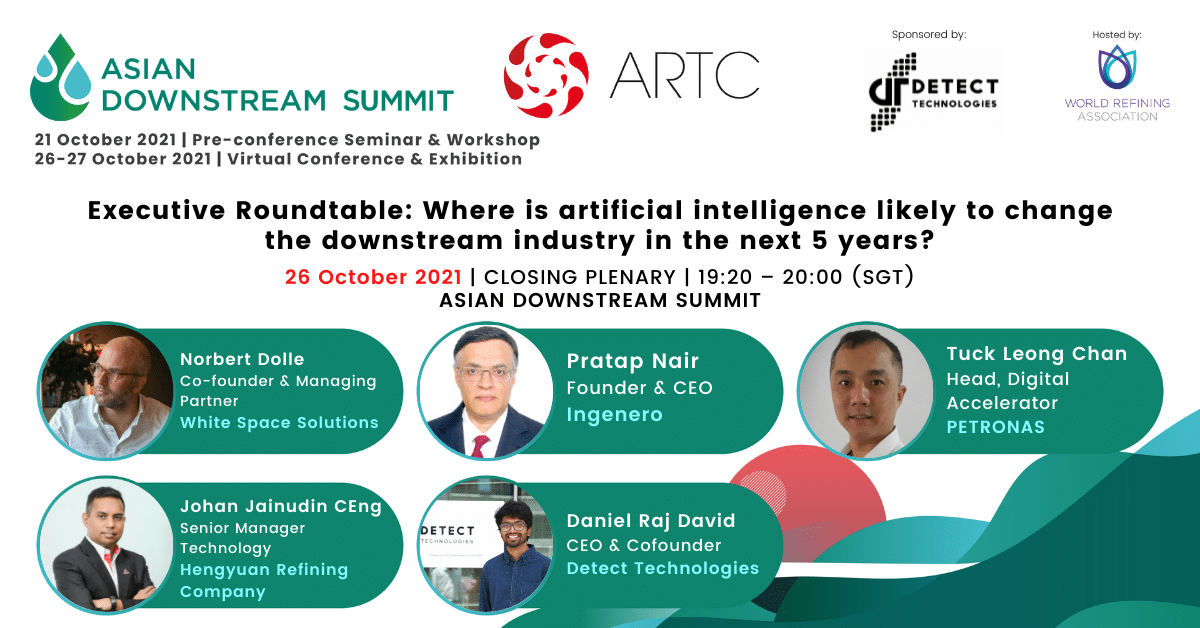

Daniel will be speaking at this year’s Asian Downstream Summit virtual conference, alongside other panellists as they discuss topics such as using integrated AI to gather unbiased data and aid decision-making processes, as well as the effect that AI has had – and will have – on the refining and petrochemicals industry.

Register for the sessions here.