Navigating the Greenhouse Gas Conundrum, and meeting new renewable growth demands

Reliability of energy delivery saves lives. Fires in California and Australia, rolling blackouts in the UK and grid failure in the dead of water in Texas are examples of events that impact people in a very real and tangible way. What’s more, overall energy demand regardless of source will increase over the next 3 decades. Against this backdrop, as a society, the impact of the supply chain ecosystems to meet the mineral demands consistent with “renewable” growth targets stated by governments worldwide, must not be overlooked.

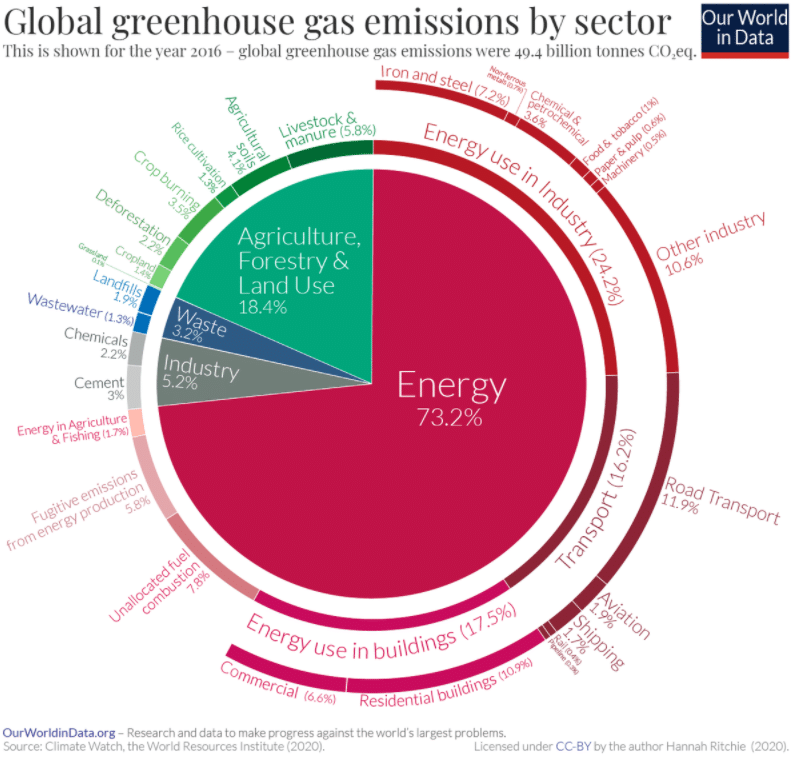

Of the 73.2% of GHG emissions due to energy consumption, 24.2% is through industrial production, 16.2% is related to transportation and 17.5% is produced from buildings, with the remaining 15.3% mostly difficult to account for. The industrial portion includes iron, steel aluminum, petrochemicals, pulp and paper, whereas Transportation includes all roads, aviation, and shipping.

The downstream oil sector delivers primarily into the industrial / transportation sector of energy use and consumer consumption.

The demand for reliable energy

One critical element within the downstream system is energy intensity i.e. the absolute temperatures necessary for molecular conversion or transformation to fuel or cracking through to petrochemical products. It may be difficult to replace GHG emitting systems because of the energy intensity demand or the substantially higher conversion cost and reliability of alternative technologies.

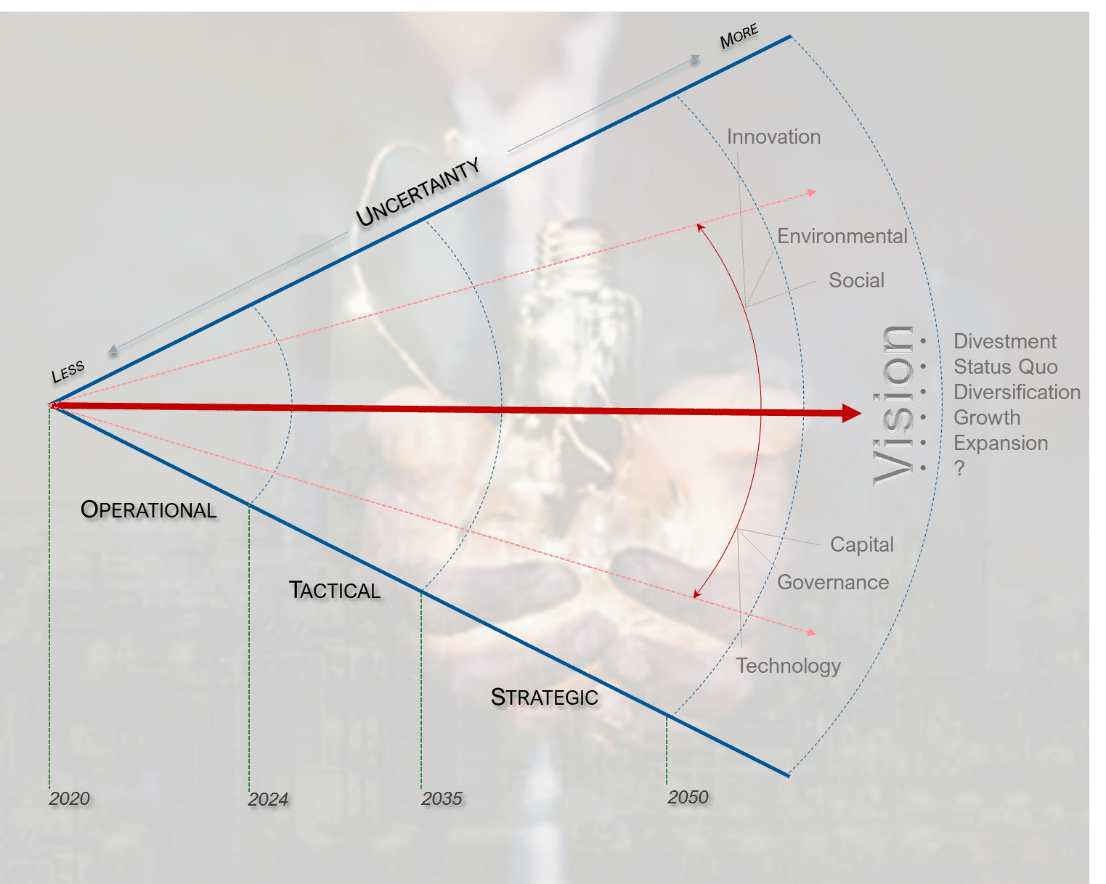

The downstream sector has to connect the vision with specific actions that can be incorporated in operational, tactical, and strategic plans. What is the focus today? What changes are needed in the next five years? And what are the fundamental changes in thinking needed to meet the objectives whilst developing a strategic vision for 2050? Waiting until everything is “known” will be too late!

“The demand for reliable energy is becoming increasingly obvious. The wind does not always blow, and the sun doesn’t always shine (and solar panels need cleaning).”

Global climate change progression is based upon model forecasts. Similarly, when adding large solar farms in the desert there will be associated changes in global air flow patterns. Transition planning should consider all forms and systems and not become focused on one over the other. “Change management is critical to understand the undesired consequences of changing energy systems.”

Cost-effective, high-value third-party analysis

Operationally, completing a third party gap analysis with a properly qualified expert company will uncover those improvements, consequences procedures and changes that can be made now to improve margins.

“Planning reviews can yield quick wins across all areas – eg, feedstocks, operations and maintenance, often with immediate value”.

Mechanical integrity analysis of existing assets can improve on-stream operations and reduce the losses from unplanned events. Validating crude/feedstock selection and operation through an effective mechanical integrity program is “cheap” and will ensure a baseline performance when moving forward into tactical planning.

Tactically this analysis defines the most “cost effective and high value” adjustments required in energy usage and delivery.

One example is moving from a power importer to power exporter through the development of a cogeneration facility. Another may be shifting from fired furnaces to resistance based electric heat input (where it make sense). The advantages can also include reliability (less reliance on the public grid) and or reducing a more GHG intense marginal source like coal.

Pulling on multiple levers to differentiate

The ability to pull on multiple levers that address strategic business planning and operational excellence will be a differentiator. The right plan will attract “Green” capital. At the same time, governments must be careful not to tip the scales in favor of one energy system or other. The extent to which systems are exposed to free markets will allow for innovation that ensures the “best” outcomes are possible which will be a combination of wind, solar, hydro nuclear and fossil fuels. Data accuracy and seasonal analysis will be critical in this shift.

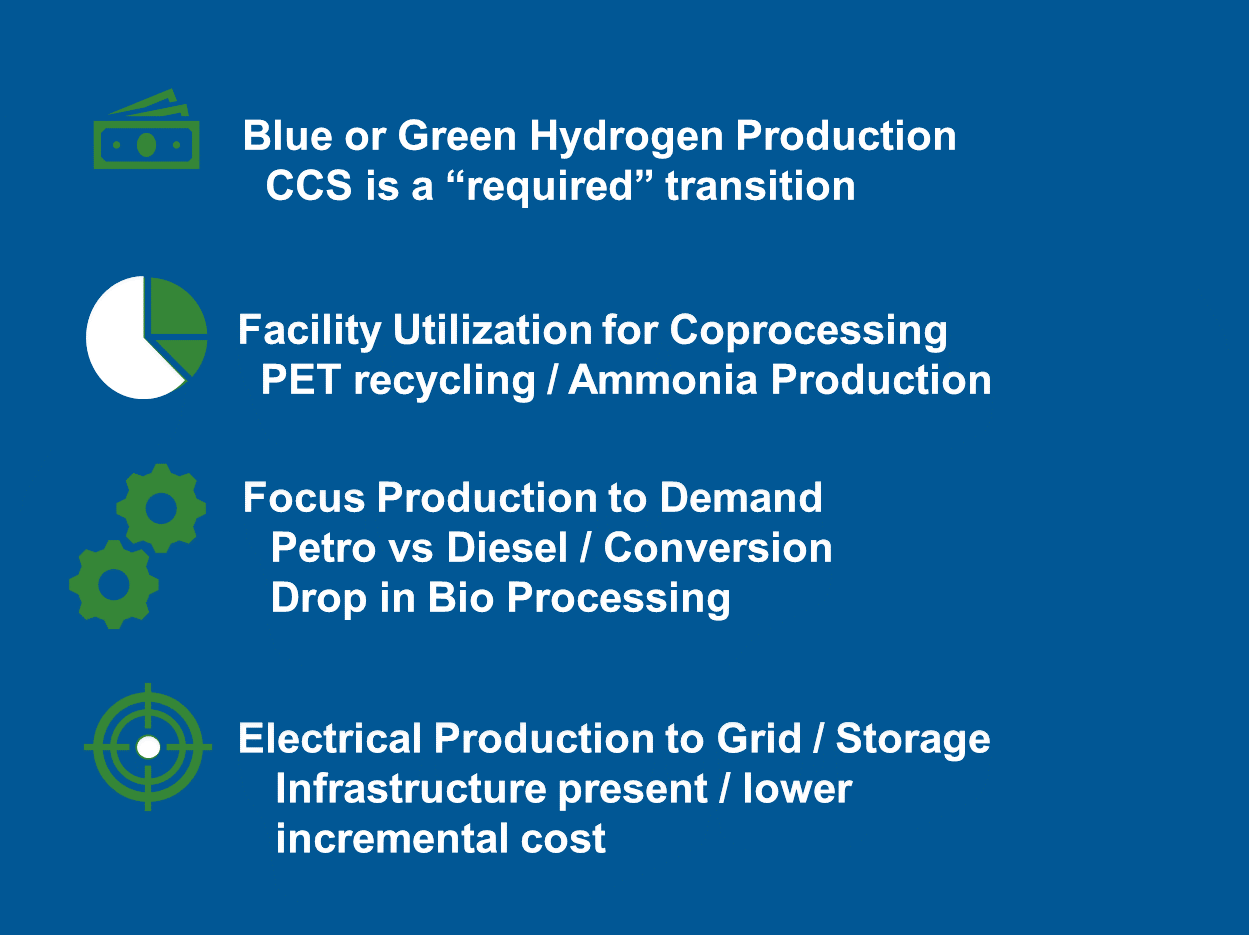

Strategic business planning will need to consider emissions as a “cost” such as carbon tax or GHG (greenhouse gas) tax. These will drive changes in hardware to meet the forward demand. The two basic pathways are: 1) Carbon Capture and Sequestration (CCS) or Energy production and consumption without any fossil source. The latter ignores the carbon footprint related to the hardware and ecosystem degradation.

When it comes to oil, there will always be a need for “first generation” production. Consider plastics recycling. There are projects to convert plastic to jet fuel, enzymatic reactions to reproduce the monomer, and other conversions. These are lauded, however without the “first generation” there is no recycling i.e. it’s a reduction but not an elimination.

Key steps towards the future

The key steps now are to reduce CO2 emissions through site energy efficiency gains and CCS. Consider also replacing hydrogen production with electrolysis hydrogen and utilizing the oxygen for other purposes.

A second step may be consideration of optimizing the site infrastructure to address plastics recycling or ammonia production as limited feed stock replacements. Also, with the goal of replacing coal, incremental power generation to the grid should be included.

The landscape is changing globally and regionally in refinery rationalization and domestic fuel security. There is no better time to chart a course for the future.

Mel Larson, Strategic Consulting Manager, Becht:

Mr. Larson has 40 years of domestic and international operations experience managing various projects and specialty consulting on Fluid Catalyst Cracking processes. His project management experience includes strategy analysis and due diligence of refinery and system wide modifications taking into account local and international market projections. His consulting services specialize in process troubleshooting and profit improvement analysis in the FCC, Unsaturates Gas Plant, Alkylation, and Naphtha Reformer areas.

John Koo, Business Development Director, Asia Pacific Operations, Becht:

John Koo has more than 30 years of experience in the oil and gas sector, specialising in Profit Improvement Programs, FCC optimisation, strategic studies, planning services, process design, overall refinery simulation, key accounts management and simulation software sales.

John is currently Business Development Director, Asia Pacific Operations at BECHT, a position he has held since October 2020. Before this, he held a number of senior roles across the oil and gas and energy sectors, including simulation business, key accounts management and technology operations.

About Becht:

Becht is a world-recognised engineering consulting firm, providing plant services and software tools to the energy sector, including upstream and downstream oil and gas, petrochemical, fertiliser, ammonia, chemical, industrial gas, fossil and nuclear power, as well as specialized support for innovative technologies including direct coal liquefaction, biomass conversion and other alternative energy processes.

Becht has the staff with global experience and regional knowledge to collaborate with operators to implement strategic plans for the future. Let us partner with you for success.

Visit https://becht.com for more information.

Read more:

- ADNOC Signs Heads of Agreement with IndianOil for Ruwais LNG Project

- SABIC Opens Multi- Million-dollar ULTEM™ Resin Manufacturing Facility in Singapore to Meet Growing Demand in Asia-Pacific

- Predictive Analytics and IoT for Pumps

- Asian Downstream Summit, Asian Refining Technology Conference, Ammonia and Carbon Capture Asia 2024 Highlights Sustainable Solutions and Celebrates Key Individuals and Organisations

- Interview with Debjit Chandra, Global Technical Service Manager for Dorf Ketal