Why Carbon Utilization May Be Key To Asia’s Decarbonization

Turning CO2 recycling initiatives into revenue streams

By Abhi Bhuchar, Eddison Lee, and Mildred Liu

Rapid economic development in Asia, spurred by industrialization, population and income growth, has triggered a surge in energy demand that will pose a major challenge for climate policymakers. Hard-to-abate heavy industrial sectors, such as concrete, steel, and mining, are pivotal for economic growth, but also are significant contributors to Asia’s carbon footprint. As the world strives for net-zero emissions by 2050, considerable investments will be necessary to develop novel approaches to the effective management and reduction of carbon dioxide (CO2) emissions.

Countries across Asia have announced decarbonization goals and energy transition frameworks that aim to reduce the intensity of CO2 and other greenhouse gas emissions through more energy-efficient industrial processes and establishment of circular economies. One example of these efforts is Australia’s Safeguard Mechanism, which imposes limits on emissions to facilities with significant emissions of greenhouse gases. Increased focus on more sustainable energy sources, such as wind and solar power, has also encouraged more investment in Asian renewables.

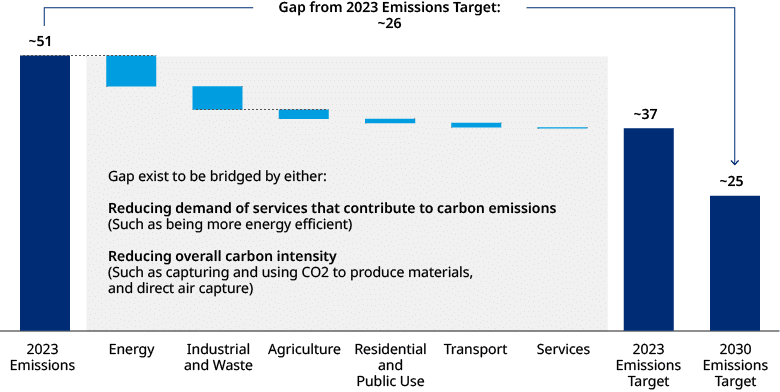

Exhibit 1: Significant emission reductions are needed to meet global net-zero pathways

In billion tons carbon dioxide equivalent (CO2e)

Yet efforts to date have been insufficient to meet the region’s energy transition goals, given escalating energy demand. Implementing multiple decarbonization strategies in the near future will thus be crucial to support Asia’s net-zero transition.

Carbon, a liability for any business

Companies are starting to recognize the potential financial and operational impacts from carbon emissions as governments start to impose carbon taxes, mandates, and other compliance measures. In response, many are starting to factor into business decisions both additional direct costs of carbon, such as compliance-related ones, and higher indirect costs from raw materials. They are also relying more heavily on carbon accounting to identify sources of emissions and quantify them to enable their mitigation.

Singapore is one of the first Asian countries to introduce carbon prices as part of its decarbonization plan. Beginning this year, large emitters will be required to pay SG$25, or US$18, per ton of CO2 emitted, with the tax progressively increasing until it reaches between SG$50 and SG$80 (US$36 to US$68) by 2030. The rising cost of carbon, as well as the increasing availability of incentives such as grants for adoption of decarbonization measures, create a clear impetus for Singapore-based companies to reduce their carbon footprint. Mounting stakeholder expectations for more extensive sustainability measures may also drive further investment in decarbonization.

Moving carbon from liability to asset

Beyond emission reduction initiatives, the next decarbonization wave has to focus on technologies that capture CO2 for removal such as geological sequestration and/or reuse. Geological sequestration, where CO2 is pressurized into liquid state and injected into porous rock formations for storage, builds upon lessons from the established industry practice of CO2 enhanced oil recovery. In enhanced oil recovery, CO2 and water are injected into an oil field to mobilize crude oil, enabling greater extraction rates. CO2 is then trapped in the geological formation where oil was once trapped.

Geological sequestration has already been commercially employed on a global scale, with more than 10 million tons of CO2 injected annually today. In addition, there are more than 130 storage sites in development globally that are capable of sequestering 110 million tons of CO2. Within Asia, Indonesia has taken the lead in its bid to become the region’s hub for CO2 storage, with 15 projects in the pipeline to date.

However, the expansion potential for carbon sequestration faces challenges, including scarcity of storage sites and high transport and long-term maintenance costs. These realities have encouraged companies to seek out alternative uses for captured CO2 in other processes and products.

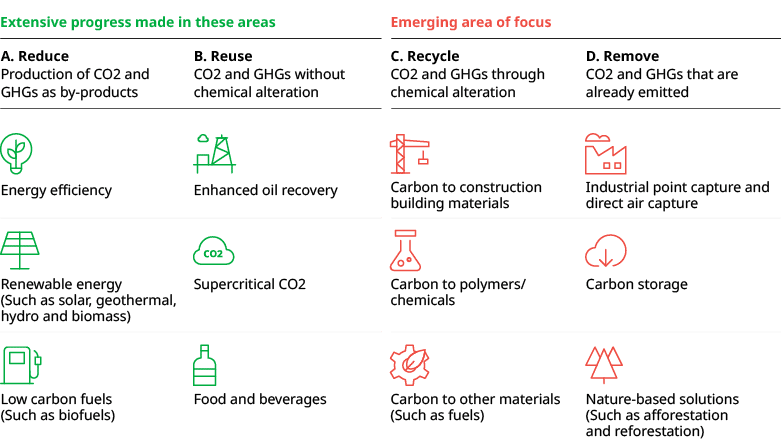

Exhibit 2: From CO2 reduction and removal solutions to ones that involve recycling and removal

The real promise for carbon utilization lies in the transformation of CO2 into valuable materials (“CO2-to X”). Captured CO2 can act as a source of carbon for industrial materials, providing the molecular backbone for construction materials, chemicals, and fuels among other possibilities. Moreover, CO2-to-X technologies can potentially use recycled CO2 to replace more carbon-intensive feedstock, helping to reduce an activity’s emissions.

The future for recycled carbon products

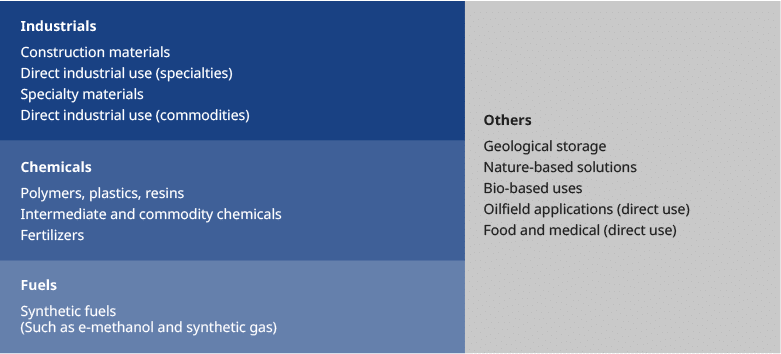

Exhibit 3: Overview of the pathways for CO2 capture and utilization

The end uses of CO2 are largely in industrial materials, chemical products, and fuels.

Multiple factors serve as tailwinds for the utilization of CO2 in products, particularly the expected acceleration of technological maturity of various pathways enabling greater adoption. One example is mineralization technology, where carbonates are formed from CO2 reacting with alkaline materials. This naturally stores and removes CO2 and has been piloted in the construction sector. While some technologies are still in the research and development stage, many should reach commercialization within the decade as interest and investments in this space increases with mounting concerns on climate change.

Regulations can also be a tailwind in supporting the economic viability and thus adoption of these emerging technologies. The establishment of regulatory incentives and carbon policies can help bridge the cost gap between conventional and CO2-based products. As the technology matures for these new carbon products, production and input costs are expected to fall, similar to the case of green hydrogen, one of the main decarbonization technologies benefiting from the US’ Reduced Inflation Act.

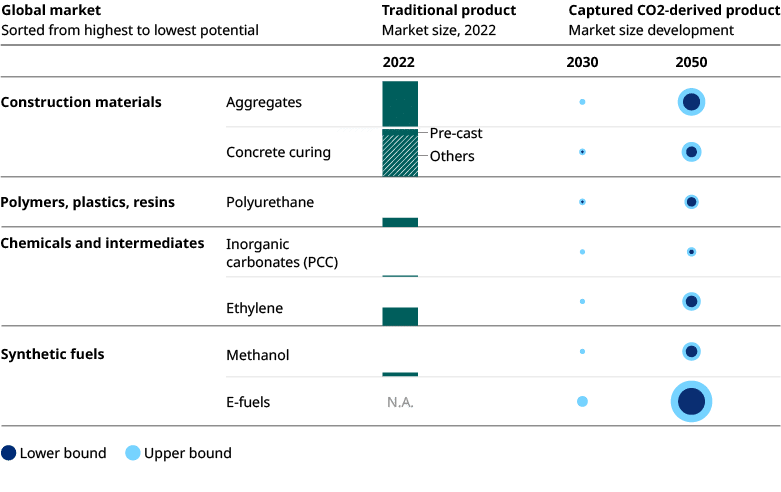

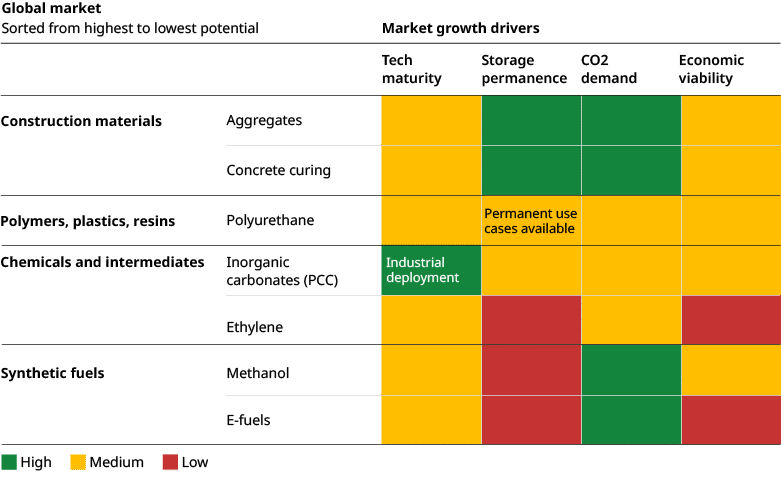

Exhibit 4: Evaluation of market potential across CO2 end-uses

With demand for sustainable products growing, companies will begin to view carbon recycling initiatives as an alternative revenue stream instead of just a compliance liability, both through sale of green products and monetization of the green premium. We recognize though that most successful green products typically demonstrate the permanence of CO2 storage and also typically the ability to abate or absorb high volumes of CO2.

CO2 in construction materials and aviation

The current market for CO2 reuse is small but growing rapidly, as companies explore opportunities for wider industrial deployment. A promising application is in the manufacture of finished concrete, which involves injecting CO2 instead of water or steam into fresh concrete. Adding CO2 reduces the amount of cement (which is highly carbon intensive to produce) in the concrete mix, thus reducing the overall carbon intensity of concrete.

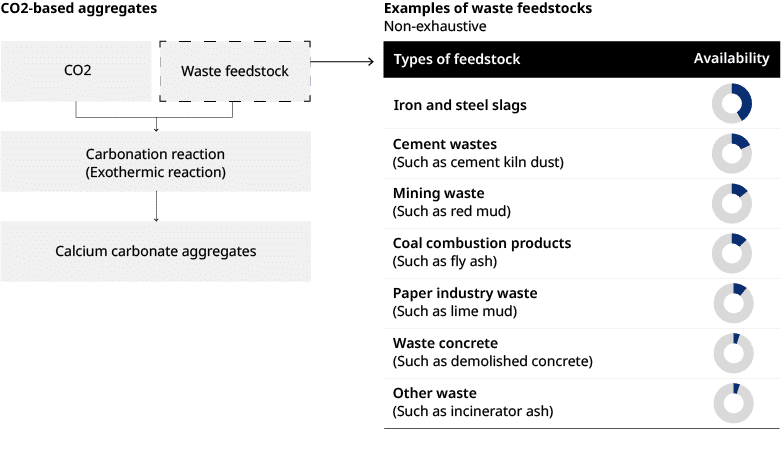

The other process involves reacting CO2 with waste feedstock to produce building aggregates or sand, as with the case of Blue Planet. CO2-based aggregates provide strength and durability comparable with traditional aggregates, and their performance in construction applications is similar to conventional products. They also offer high carbon abatement potential, including the volume and permanence of carbon retention.

Exhibit 5: CO2-based aggregates offer high potential for the utilization of CO2

Additionally, this approach provides an effective waste management solution by utilizing industrial waste as feedstock, reducing the reliance on traditional raw materials, and promoting a circular economy approach.

Aviation is another hard-to-abate sector. Options for airlines to abate CO2 emissions are limited, given capturing emissions in-flight is not possible. At the same time, due to significant challenges with the adoption of carbon-free alternatives, such as electric-powered batteries or hydrogen, it is critical to utilize carbon-containing fuels.

While still in its infancy, CO2-based sustainable aviation fuel (SAF) could complement bio-based Sustainable Aviation Fuel’s role in decarbonizing aviation. Players such as the SAF+ Consortium, a conglomerate of several companies in the synthetic fuels value chain, have already launched demonstration plants. Utilizing fuel derived from captured CO2 could displace more emissive fuel feedstock and potentially lower the lifecycle emissions of jet fuel. While the ultimate emission benefit is subject to stringent standards on CO2 sources and production technology, it could still be a useful initiative, and help the sector achieve its net-zero ambitions.

Stakeholder support for carbon recycling

As we focus on ways to shrink the global economy’s reliance on carbon, it is important to understand the drivers for carbon recycling and how improvements in carbon capture technology and more efficient feedstock handling, for example, can decrease input costs and make the associated carbon recycling initiatives economically viable.

Growing carbon compliance costs will act as a catalyst for the widespread adoption of carbon recycling initiatives, incentivizing companies to embrace alternatives with reduced carbon footprints. At the same time, certification programs such as Singapore’s Building and Construction Authority (BCA) Green Mark, empowers consumers to identify and select sustainable alternatives, further augmenting this shift.

Partnerships between end users and technology providers are crucial to leverage industrial know-how and pilot initiatives to overcome barriers and expedite the evolution of these technologies. Additionally, buyers of carbon-recycled products must work closely with end users to understand their willingness to pay for sustainable solutions. Identifying opportunities to share material acquisition costs can establish mutually beneficial arrangements to help guarantee product offtake.

Ultimately, supportive policies will be key in facilitating this transition. Governments can directly drive the adoption of CO2-to-X products by incorporating them into public procurement processes. Indirectly, they can set carbon prices and implement policies that encourage the adoption of CO2-to-X technologies. For example, Singapore’s Green Mark certification accords points for usage of CO2-based concrete and aggregates, with gross floor area incentives awarded for developers who achieve the top certification.

Carbon markets as catalysts for CO2-to-X adoption

Carbon-trading systems adopt a market-based approach by placing a price on carbon emissions. There are two key types of systems: voluntary participation, and regulatory mechanisms such as emissions trading schemes. As the focus on sustainability targets intensifies, carbon market dynamics and their potential in propelling CO2 utilization initiatives demand a closer examination.

Both types of carbon markets are relatively nascent but developing quickly. In the Asia-Pacific region, we see the dominance of voluntary mechanisms, with only a handful of countries, such as South Korea and Australia, having adopted mandated emission reduction mechanisms. However, carbon markets often require strict standards and verification processes for which these CO2 recycling projects have no frameworks in place yet, limiting project launches.

Nonetheless, companies are increasingly looking to monetize CO2. Once guidelines within the voluntary markets are in place, CO2 utilization initiatives will become an attractive approach, as companies will be able to generate carbon credits by converting CO2 into products. Moving forward, credits linked to CO2-based products could potentially exhibit higher quality in terms of carbon abatement potential, such as building materials with increased permanence, adding another layer of value to the market.

Call to action for CO2-to-X market participants

Everyone needs to work collectively to maximize the potential for carbon utilization. Continued R&D efforts will drive large-scale adoption by lowering the technological costs and improving the operational efficiency of CO2-to-X processes. To achieve broader public acceptance, manufacturers will also need to work with regulatory bodies to facilitate the testing of CO2-based products and demonstrate their reliable performance. A great example is A*STAR’s Low Carbon Technology Translational Testbed (LCT3) in Singapore, which aims to support new technological developments spearheaded by both corporates and relevant government agencies. Beyond these, players must also evaluate the optimal location for manufacturing, balancing the availability and cost of feedstock such as CO2, green hydrogen and other feedstocks, as well as the proximity to end customer. These factors, along with applicability of carbon pricing schemes and other incentives, will have a direct impact on the commercial viability of the venture.

As manufacturers scale up production, policymakers must provide a stable regulatory framework and incentives that encourage the continued development and commercialization of CO2-to-X technologies. Without sufficient regulatory backing, the barriers preventing the large-scale uptake of these technologies will continue to be higher than the benefits associated.

Consumers will also play a crucial role. Successful end users will recognize the potential economic benefits of using CO2-based products, particularly when considering the long-term impact of carbon price on operations and the bottom line. End users will also be key in the evolution of these technologies, by working together with technology providers and manufacturers to solve operational challenges.

Looking ahead through an Asian lens

Despite growing enthusiasm, collective financial commitment to CO2-to-X technologies remains modest compared with recent clean technology investments in electric vehicles and batteries. Although the region presents strong potential for CO2-to-X adoption, most companies and governments in the emerging Asia are still adopting a wait-and-see attitude. For CO2-to-X initiatives to contribute significantly to Asia’s decarbonization journey, increased international cooperation and participation from the private sector will be required, similar to what has driven the scaling of renewable energy.

Nonetheless, we believe the prevalence of CO2-to-X deployment will increase in Asia. First, access to viable CO2 storage sites is limited, necessitating a shift towards the utilization of CO2. Home to an innovation-driven market, the region also offers technological capabilities to develop CO2-to-X technologies at scale. More importantly, government involvement in the energy sector is high, along with strong collaboration efforts with international energy companies. For example, government linked firms Keppel and Surbana Jurong partnered with industry players such as Chevron and Pan United among others to jointly develop and commercialize carbon capture, utilization, and storage (CCUS) applications. We expect public-private partnerships to continue to play a key role in facilitating the transition to CO2-to-X technologies.

Ultimately, the utilization of CO2 should be regarded as a supplementary measure, rather than a substitute for CO2 storage or direct reductions in businesses’ carbon footprint. While CO2-to-X initiatives may not yield emission reductions of a comparable magnitude in the near term, they can still contribute to the successful attainment of climate objectives when implemented as part of a comprehensive decarbonization strategy.