Thinking different: Taking the TOTEX approach

By Elias Panasuik

Every evolution requires a different mindset and a willingness to think differently.

We find ourselves in extremely challenging times. The realities of a post-COVID world are still unclear while enormous pressure exists to continue to reduce capital project costs, reduce operating costs, reduce energy consumption, meet environmental sustainability targets, and all with less resources and people.

But what if we use this time to think differently? Now is the right time to redefine how we approach capital and operational investments.

An era of change – Is now the time for TOTEX?

The first way to think differently is to take a total expenditure (TOTEX) approach, spending money to achieve outcomes regardless of its CAPEX or OPEX. A dollar is a dollar, no matter when you spend it! So, choose where you get the best overall return.

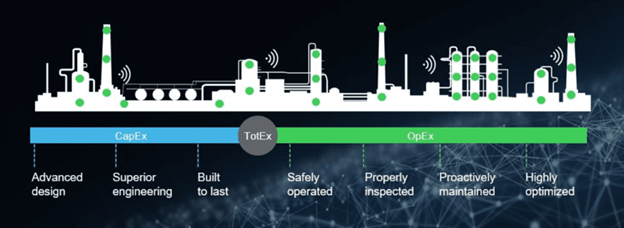

Historically, the approach is to think of capital spend (CAPEX) and operational spend (OPEX) as separate buckets, without necessarily tying these together in a whole-of-life total expenditure (TOTEX) view. The TOTEX (Capital Expenditure + Operational Expenditure) approach looks at the total cost of expenditure, over the long-term operating life of the plant.

Put simply, an opportunity may appear relatively expensive in terms of CAPEX, but under the TOTEX approach, appear to present tangible economic benefits with attractive payback period. Investing a dollar more during CAPEX may deliver tenfold benefits during the plant life.

It’s the whole life cost of the asset that is crucial, not just the initial outlay.

Taking a TOTEX approach focuses on the dollar required, not if it’s a CAPEX or OPEX dollar. These lines can blur when dealing with a refurbishment, major turnaround or significant periodic maintenance. A major piece of equipment may be replaced, purchased as CAPEX so that it can be capitalised, put on the book as an asset, then depreciated over time. It’s never as simple as one or the other, as represented below:

Secondly, a TOTEX approach forces us to think more broadly. For example, when thinking about the end-to-end life of an asset, teams responsible for designing the electrical power and process design normally only worry about their specific domains and their part in the lifecycle. Rarely do those designing the plant think about the operation and maintenance of the plant (this could be as simple as where equipment is located during the design that then creates confined workspace challenges for maintenance teams).

Questioning traditional beliefs, changing basic design assumptions, or using different tools allow engineers and asset teams to get all options on the table early, while trading short term investment decisions versus long-term performance goals. More informed decisions can be made that better ensure that technology delivered is lower cost and faster cycle than those of the past. This approach also avoids a “That’s not my problem, we will worry about that once the plants up and running” mindset.

Optimise TOTEX through a combined power/process information-driven approach

A fundamental requirement of managing TOTEX is that decisions must be made based on quantitative measures to optimise the total cost of ownership. A prerequisite of any TOTEX reduction initiative must be the acquisition of data that is reliable, accurate and current.

One approach to getting to this level of accurate data is to integrate electrical and process information from design through operation and evolution. This integration brings greater knowledge of both process and electrical limits, increased collaboration to explore energy saving opportunities or make energy efficient decisions and faster diagnosis of anomalies and trips.

Move away from experience and intuition to data and analysis

In a TOTEX approach, it is important to establish an accurate baseline which is why accurate design information from the CAPEX phase is important as it allows us to move away from “experience and intuition” to “data and analysis.”

One critical measurement is energy consumption as this has a significant economic impact. However, this needs to be put into the context of production throughput. For example, if a pump is drawing more current, is it because it is running harder due to increased production demand, or is it because the pump is beginning to fail? Is there more resistance in the pump shaft that causes the motor to work harder? Historically it has been difficult to do this on live operating plants, however, advances in technology now make this possible.

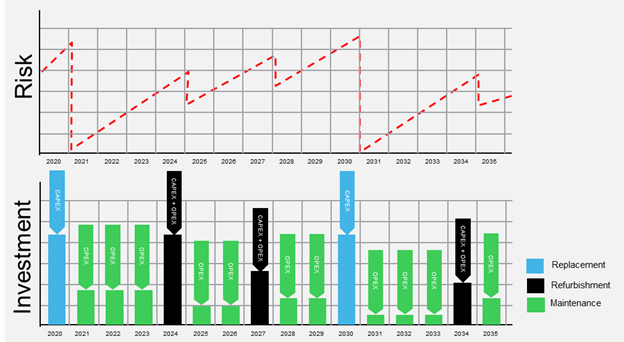

Data-driven decision making is defined not only by collecting data, but also by how and if it is used in making crucial decisions. Take a pump, for example, how do you decide between the purchase of a higher-grade pump during CAPEX that requires less overall maintenance, or a lower cost pump that requires more maintenance throughout the operating life? When is the best time to undertake maintenance? When combined, which delivers the better TOTEX?

There are also long-term strategic benefits using asset performance data. Over time, a picture is built of the equipment under different operating conditions, that can then be used to optimise its performance. The same picture can be used to determine “what good looks like” so you know how to operate and maintain that equipment for optimum performance. With the pump example, if performance is starting to deviate or deteriorate, earlier alerts will avoid costly failures.

Collaboration and transparent communication are key

An organisation’s ability to plan for value is supported (or impaired) by how coordinated it is across people, process and technology. For example, better coordination of the electrical power and process automation teams delivers better overall results. And the finance team needs to be included in this journey. Finance is traditionally focused on cost centers, profit centers, P&L, but on the other side, asset managers, reliability manager, operations manager, maintenance managers are concerned about costs attributed to an asset or group of assets, process unit or event site. Alignment and collaboration cross organisation is required.

Integrate power and process to catapult operational resilience

While a TOTEX approach may be relatively new to some, the approach has already been adopted within regulated industries which are heavily dependent on infrastructure assets such as the Water industry. The move to TOTEX based regulation is motivated by a desire to enable outcomes based on full economic consequences. These decisions are no longer classified as CAPEX or OPEX, but rather based on long-term investment value.

A TOTEX approach increases the flexibility of decision making and provides greater freedom to pursue innovation with better collaboration of finance, engineering, operations, and maintenance teams to deliver total lifecycle value.

As your digital partner for sustainability and efficiency, Schneider Electric realises the integration of power and process is a catalyst for operational resilience, efficiency, and improved sustainability across the lifecycle of the plant. We offer you our latest technology breakthrough and execution methodology – EcoStruxure Power and Process.

EcoStruxure Power and Process redefines your operation – consolidating your automation and electrical operations to boost your plant performance while simultaneously lowering your cost. This will allow your enterprise to become more agile, effective, smarter and more sustainable.

Explore more about the Schneider Electric approach to this integration in this reference paper, Eight Strategies to Drive Enterprise Profitability through Integrated Power Management and Process Automation.

About the author

Elias Panasuik leads the EcoStruxure Power and Process program globally He spent 20 years in leadership roles in energy and automation with end-users and vendor organizations in Calgary, Canada, and now calls the USA home. Elias speaks regularly at industry events, including keynotes with industry organizations, colleges, and recently delivered a TEDx talk on corporate sustainability to a private end-user executive audience.